E-House (China) Holdings Limited (EJ) shares are up more than 2% to $5.85 in pre-market trading Wednesday after the company reported its fourth quarter earnings results.

The real estate services firm reported non-GAAP earnings of $0.14 per share on revenues of $312.32 million, up 22.3% from $255.4 million a year ago. Analysts were expecting EPS of $0.18 on revenues of $281 million.

For the full-year 2014, the company reported total revenues of $904.5 million, or $0.26 per diluted share, an increase of 24% from $731.1 million for 2013. For FY/15, EJ guided revenue projection of $1.05-$1.10 billion, compared to the consensus revenue estimate of $1.05 billion. EJ’s guidance represents an increase of 16% to 22% from $904.5 million in FY/14.

Also today, E-House announced that its board of directors had authorized and approved the company’s payment of a cash dividend of $0.15 per ordinary share ($0.15 per ADS). The cash dividend will be payable on or about May 15, 2015 to shareholders of record as of the close of business on April 10, 2015.

On valuation measures, E-House (China) Holdings Ltd. ADS shares, which currently have an average 3-month trading volume of 958K shares, trade at a trailing-12 P/E of 15.92, a forward P/E of 7.35 and a P/E to growth ratio of 0.45. The median Wall Street price target on the name is $15.15 with a high target of $16.00. Currently ticker boasts 2 ‘Buy’ endorsements, compared to 1 ’Hold’ and no ‘Sell’.

Profitability-wise, EJ has a t-12 profit and operating margin of 6.27% and 8.16%, respectively. The $808.34 million market cap company reported $630.6 million in cash vs. $519.6 million in total liabilities in its most recent quarter.

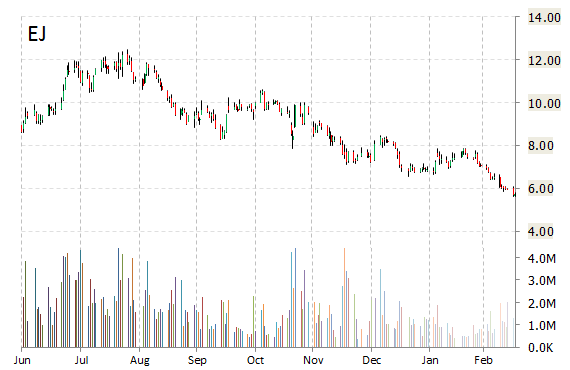

EJ currently prints a one year loss of about 54% and a year-to-date loss of around 21%.

E-House (China) Holdings Ltd. operates as a real estate services company primarily in the People’s Republic of China. The company was founded in 2000 and is headquartered in Shanghai.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply