Penn West Petroleum Ltd. (PWE) reported fourth quarter 2014 EPS of ($3.57) before the opening bell Thursday, compared to ($1.38) from the corresponding period in 2013. Revenues decreased 24.0% from last year to $473 million. Analysts expected revenues of $461.11 million.

For full-year 2014, the oil and natural gas producer reported “average production volumes was 103,989 boe per day, which was above the mid-point of full-year guidance, on capital development spending of $732 million and generated $935 million of funds flow.”

Separately, the company announced that the Board of Directors has declared a Q1/15 dividend of $0.01 per share to be paid on April 15, 2015 to shareholders of record at the close of business on March 31, 2015.

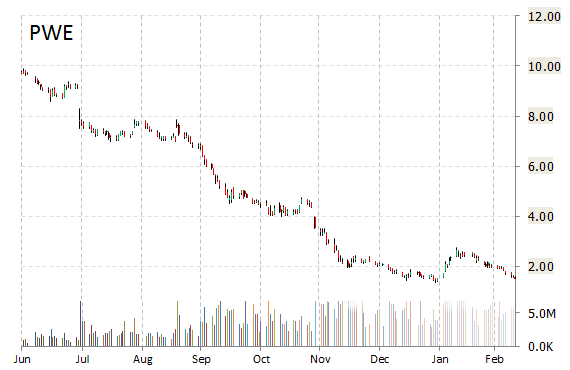

On valuation measures, Penn West Petroleum Ltd. shares, which currently have an average 3-month trading volume of 6.57 million shares, trade at a P/E to growth ratio of 10.35. The median Wall Street price target on the name is $2.00 with a high target of $5.82. Currently ticker has 1 ‘Buy’ endorsement, compared to 6 ’Holds’ and 9 ‘Sell’.

Profitability-wise, PWE has a t-12 profit and operating margin of (29.2%) and (18.14%), respectively. As at Dec. 31, 2014, the $750.95 million market cap company reported $2.1 billion of fixed interest rate debt instruments with an average interest rate of 6%.

PWE currently prints a one year loss of 81.17% and a year-to-date loss of around 27.50%.

Penn West Petroleum Ltd. is one of the largest conventional oil and natural gas producers in Canada. The firm was founded in 1979 and is headquartered in Calgary, Canada.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply