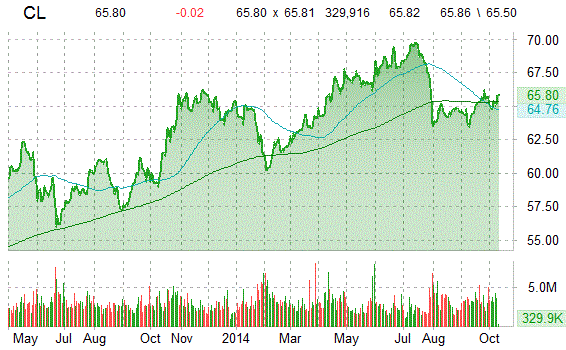

Shares of Colgate-Palmolive Co. (CL) were downgraded to a ‘Market Perform’ rating from ‘Outperform’ by BMO Capital Markets on Thursday. The firm also cut its 12-month base case estimate to $70 from $75.

CL shares recently lost $0.01 to $65.81. In the past 52 weeks, shares of New York-based company have traded between a low of $59.75 and a high of $70.11. Shares are up 14.03% year-over-year and 2.54% year-to-date.

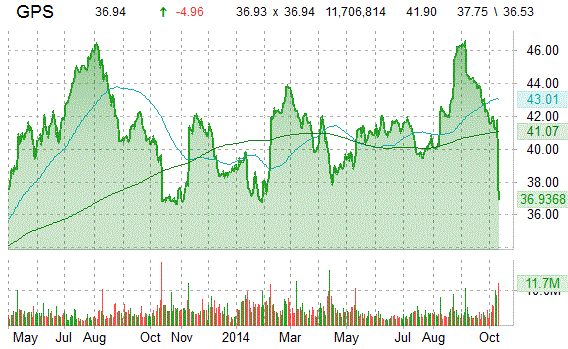

Shares of The Gap, Inc. (GPS) are down 12.68% to $36.65 in early trade after Wells Fargo (WFC) downgraded its rating to ‘Market Perform’ from ‘Outperform’. Gap shares were also downgraded to ‘Neutral’ from ‘Buy’ at Janney and Sterne Agee. Price target lowered to $41 from $50 and to $40 from $52, respectively.

Gap shares are down more than 5% this year and have fallen roughly 6.30% over the past 12 months.

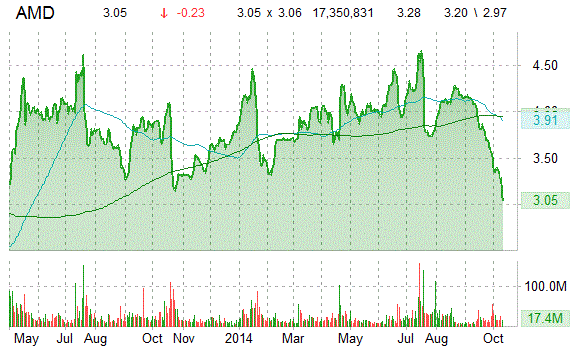

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

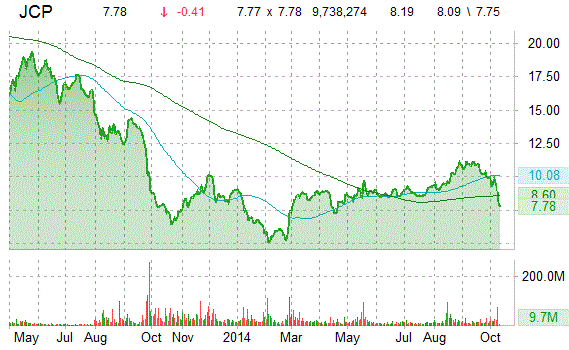

J.C. Penney (JCP) was downgraded to ‘Sell’ from ‘Hold’ at Craig Hallum.

JCP shares recently lost $0.33 to $7.86. The stock is up more than 5.41% year-over-year and has lost roughly 10.49% year-to-date. In the past 52 weeks, shares of Plano, Texas-based company have traded between a low of $4.90 and a high of $11.30. Currently there are 3 analysts that rate JCP a ‘Buy’, while 13 rate it a ‘Hold’. 6 analysts rate it a ‘Sell’. JCP has a median Wall Street price target of $10.00 with a high target of $15.00.

J. C. Penney has a total market cap of $2.40B.

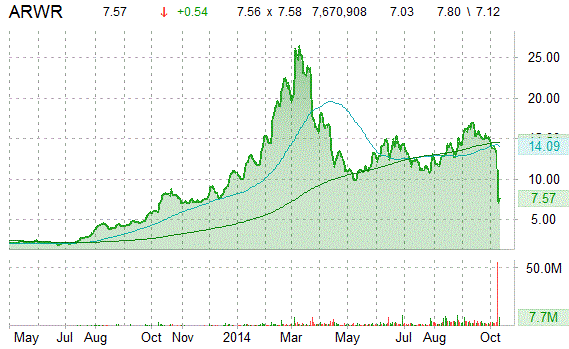

Arrowhead Research Corp. (ARWR) had its price target lowered to $12 from $24 by analysts at Piper Jaffray on Thursday.

ARWR shares recently gained $0.54 to $7.57. Piper’s target price suggests a potential upside of about 61.29% from the company’s current stock price. Arrowhead was also downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital citing low-end efficacy in the AASLD abstract. 12-month base case estimate lowered to $9.

In the past 52 weeks, shares of Pasadena, California-based company have traded between a low of $5.47 and a high of $27.63. Shares are up 3.08% year-over-year ; down 35.21% year-to-date.

Shares of Advanced Micro Devices, Inc. (AMD) were downgraded to a ‘Neutral’ rating from ‘Outperform’ by Wedbush on Thursday. The firm also cut its 12-month base case estimate to $3 from $6.

In other AMD news ; the company today announced that its board of directors has appointed Dr. Lisa Su as president and chief executive officer and member of the board of directors, effective immediately.

AMD shares are currently priced at 28.69x this year’s forecasted earnings, which makes them expensive compared to the industry’s 8.97x earnings multiple. Ticker has a forward P/E of 19.06 and t-12 price-to-sales ratio of 0.43. EPS for the same period is $0.11.

In the past 52 weeks, shares of Sunnyvale, California-based firm have traded between a low of $2.97 and a high of $4.80 and are now at $3.07. Shares are down 11.83% year-over-year and 15.25% year-to-date.

Leave a Reply