As banks repay their loans from the Long-Term Refinancing Operation, the ECB’s balance sheet is shrinking. This column argues that, given the slow recovery and sustained low inflation, the ECB should replace its bank lending programme with quantitative easing. Buying short-term government debt would be consistent with the ECB’s inflation target, would keep the ECB’s monetary policy separate from its role in bank supervision, and would create a built-in exit strategy from unconventional policy.

Europe’s modest economic recovery and uncomfortably low inflation put the ECB in a bind. Although economic conditions are improving gradually (European Commission 2014), concerns about the potentially negative impacts of deflation persist (Armstrong et al. 2014). The ECB’s top near-term priorities are to avoid deflation (and apparently even sustained low inflation) and extend the economic recovery. It also does not want to extend monetary policy beyond its natural scope and take pressure off EU nations to proceed with economic and regulatory reforms that will lift longer-run potential growth. ECB President Draghi indicated at his press conference at the conclusion of the May Governing Council meeting that the central bank would likely ease monetary policy at its June meeting. An array of alternatives are being considered.

Under current circumstances – in the economy, monetary policy, and banking – I recommend that the ECB announce that it will replace its Long-Term Refinancing Operation bank lending programme with a quantitative easing programme in which it purchases shorter-term sovereign debt. There’s a rationale for this kind of monetary policy. Europe’s growth in aggregate demand is too slow to facilitate healthy real growth and low inflation while accommodating further necessary economic adjustments. The ECB’s balance sheet is shrinking and monetary policy is effectively getting tighter. Commercial bank lending is constrained and the monetary policy channels are clogged. A well-designed QE programme that enhances liquidity and stimulates aggregate demand, but also avoids unnecessary credit policy and involves a predictable exit policy, would be consistent with the ECB’s 2% long-run inflation target.

Slow recovery and low inflation

European economies are recovering slowly from financial crisis and recession, but aggregate demand remains soft. Through 2013Q4, nominal GDP has been growing slower than real potential. It rose 0.4% in the year ending 2012Q4 and 1.6% in the year ending 2013Q4. This is less than half of the average nominal growth during the 2002–2007 expansion.

The insufficient growth in aggregate demand and lingering double-digit unemployment, accentuated by austerity policies and private sector adjustments, have exerted downward pressure on wages and unit labour costs. No surprise, inflation has declined, to 0.7% from 1.3% a year ago and 2.6% in April 2012.

Although the probability of deflation is low, it cannot be ruled out in the context of Europe’s modest growth in aggregate demand and the need for further wage and price adjustments. The concern among policymakers is that even a temporary, modest deflation (or even sustained very low inflation) could generate expectations of future price declines that would deter consumer spending and business investment. Japan’s two decade-long bout with deflation and recession highlights the downside of misguided policies that resulted in virtually flat nominal GDP and sustained under-performance (Levy 2014).

Painful adjustments following Europe’s earlier excesses of wages, unit labour costs, and debt-financed spending are contributing to the lower inflation, but in reality they are part of Europe’s solution and reflect progress toward future healthy sustained growth. Without those downward adjustments in inflation and wages, Europe’s economy would be languishing, it would be lacking international competitiveness, and its outlook would be dim. Now, European economies are benefiting from earlier reforms and conditions are improving. But further economic progress and deleveraging is required, and slow growth in nominal spending is elongating the adjustments.

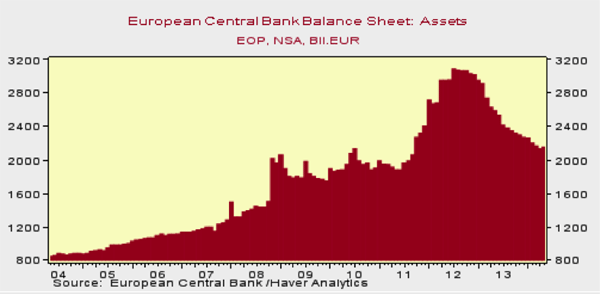

The ECB’s shrinking balance sheet

Under current conditions, the current shrinkage of the ECB’s balance sheet and declines in bank lending are unwelcome trends. European banks have been paying back loans from the ECB’s LTRO lending programme, and some have stepped up repayments as they prepare for the ECB-supervised Asset Quality Reviews and subsequent stress tests. Although these loan repayments reflect improved bank balance sheets and perhaps fewer attractive lending and investment opportunities, they shrink the ECB’s balance sheet and lower the amount of excess reserves in the banking system. At the same time, the lower inflation has raised the ECB’s real refi rate. The ECB’s monetary policy is effectively getting tighter. Looking forward, the residual of the LTRO loans are due to expire in October–November 2014, and this will contribute to a further diminution of bank reserves.

Figure 1. The ECB’s balance sheet

Bank lending and credit standards

At the same time, bank lending continues to decline. Loan demand tends to lag the cycle, so with real GDP still 2.7% below its pre-recession (2008–2009) peak, it’s not surprising that loan demand is soft. In the US, commercial and industrial loans – which fell nearly 25% from their peak – declined for more than a year into economic recovery, and didn’t recover to their prior peak until late 2013, nearly 4 1/2 years into expansion. US consumer loans are now increasing, but commercial banks are losing market share to other sources of credit, including credit unions and the Federal government (student loans). Europe is just concluding its first year of recovery, so it will take time for loan demand to rebuild. Patience is required.

The weak loan demand in Europe has been accompanied by constrained bank credit supply. Banks have been undercapitalised, and are striving to reduce nonperforming loans and increase credit quality. Faced with the rigours of the ECB’s AQRs and upcoming stress test, banks have been raising capital and are striving to reduce risk-weighted assets. Although the ECB’s most recent bank lending surveys indicate that credit standards on loans to enterprises and households have eased, most indicators suggest ongoing credit restraint (ECB 2014).

Good news in Europe

Positive themes dominate Europe’s economic and financial news. The expansion continues to take hold in both troubled and core nations, supporting forecasts of sustained moderate growth. Consumption and business fixed investment are rising modestly, as are exports, despite the strong euro. Confidence surveys are pointing up, undeterred by policymakers’ concerns about low inflation. Bank capital and liquidity have improved. The rather dramatic declines in sovereign bond yields are reducing debt-service costs. Key troubled EU nations no longer need financial support. Greece’s successful bond issuance epitomises Europe’s significant financial progress.

While Europe’s outlook is becoming increasingly favourable, conditions remain fragile. This is an inappropriate time for the ECB’s unintended monetary tightening. Taking steps to offset this monetary trend would help to sustain the recovery in aggregate demand as economic reforms and austerity are implemented, and would be consistent with the ECB’s long-run 2% inflation target.

A quantitative easing proposal

The ECB should announce a quantitative easing programme that replaces its rapidly diminishing LTRO programme. A properly structured QE programme would carefully define the magnitude and type of assets purchased by the ECB, with the following characteristics:

- It should focus directly on the ECB’s mandate of maintaining aggregate demand growth consistent with its long-run inflation target;

- It should confine itself to monetary policy while steering clear of credit policy; and

- It should have a built-in exit strategy that facilitates a smooth monetary policy normalisation.

Here, the ECB can learn from the communications challenges faced by the US Federal Reserve’s open-ended QE.

The ECB’s QE should involve a year-long purchase programme of up to €400 billion of sovereign debt securities with three-year or less maturities. These asset purchases would offset the shrinkage of reserves in the banking system as banks repay the remainder of their LTRO loans. Replacing bank loans with purchases of sovereign debt would remove the ECB from credit policy and improve its credit quality by reducing its exposure to risky bank loans.

The composition of the ECB’s purchases of sovereign debt by country should be consistent with its role as central banker of the EMU. This may involve aligning the purchases with the ECB’s distribution of seigniorage to the national central banks, or a weighting based on their relative capitalisation.

The financial crisis has passed, and banks are rebuilding capital and liquidity. A QE programme of purchasing sovereign debt to replace bank loans would enhance the ECB’s monetary stimulus while creating separation between the ECB’s monetary policy and its role in supervising the bank AQRs and stress tests. In contrast, alternative suggestions that the ECB purchase asset-backed securities or implement a funding-for-lending programme – both in attempts to stimulate bank lending – would involve the ECB directly in credit policy, greatly muddling its role. Bank lending is on a cyclical course toward recovery – it will take time regardless of the monetary policy remedy. Monetary-credit policies designed to boost bank lending are unnecessary and only generate undesired distortions in credit markets.

Limiting the QE to three-year and under sovereign debt securities would build in an eventual natural unwinding of the ECB’s balance sheet. The Fed has made the mistake of buying mostly long-dated securities such that the unnecessary bloat in its balance sheet and excess reserves in the US banking system will remain long after the economy and banking system have fully repaired. This has greatly complicated the Fed’s communications about when it will normalise monetary policy.

Three years from now, if all goes well, Europe’s economy will be on a sustainable growth path, five years into the economic expansion, and the banking system will be almost fully capitalised and liquid. At that time, a natural run-off of excess reserves would facilitate a smooth monetary policy normalisation for the ECB.

References

•Armstrong, Angus, Francesco Caselli, Jagjit Chadha, and Wouter den Haan (2014), “Eurozone deflation could derail UK recovery: Results of the second Centre for Macroeconomics survey”, VoxEU.org, 13 May.

•European Central Bank (2014), “The Euro Area Bank Lending Survey”, April.

•European Commission (2014), “Winter 2014 forecast: Recovery gaining ground”, 25 February.

•Marco Buti, Maria Demertzis, and Joao Nogueira Martins (2014), “Delivering the Eurozone ‘Consistent Trinity’”, 30 March.

•Mickey D Levy (2014), “Clarifying the debate about deflation concerns”, VoxEU.org, 21 February.

•International Monetary Fund (2014), “World Economic Outlook: Recovery Strengthens, Remains Uneven”, April.

Leave a Reply