Keys. Phone. Wallet.

Wait – scratch that…

Keys. Phone. Ditch the wallet…

Your mental check list is about to get 33% shorter. And that’s partly because the S&P’s largest company is developing its next big business right under the market’ nose.

But let’s back up for just a second.

What do you think is Apple’s fastest-growing product by total dollar sales? Here’s a hint: It’s not the iPhone or the iPad.

“The answer is e-commerce,” explains Rude researcher Noah Sugarman. “Sales of Apple apps, iTunes, and iBooks jumped 19% to $4.4 billion during the first quarter.”

Apple management has taken notice too, commenting that its customers are lauding the use of Touch ID to buy content like movies and music. But in the works is something a lot bigger than downloading your favorite Justin Bieber album…

“Apple already has the tech and the products in place it needs to build a massive mobile payments business,” Noah continues. “The company is expanding on not just content purchases, but on in-store purchases as well. Apple is simultaneously creating a mobile retail marketing infrastructure across the U.S. called iBeacon. That’s alongside key partnerships with CC companies, Google, Square, Stripe, and others.”

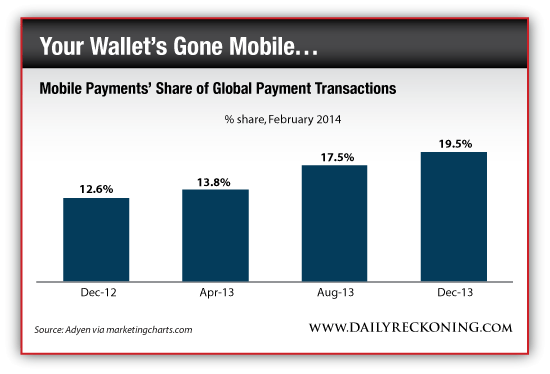

In fact, Apple (AAPL) is just one of the many companies that recognizes mobile represents the next frontier in payment transactions. Globally, 1 in 5 of such transactions are now made from a mobile device.

But we’re only in the beginning stages of this revolution. Visa (V) and MasterCard (MC) both plan to allow phones with near-field communication chips (NFC) to access card info over the internet.

“Meanwhile, Samsung has announced its new Galaxy S5 will allow consumers to authenticate PayPal transactions with a fingerprint rather than a password,” Noah continues. “PayPal itself is also partnering with merchants to equip them with wireless sensors so that repeat customers can pay while leaving their phones in their pocket.”

This coming technology evolution will change not just what you spend your money on, but how you spend it. Safety and security concerns have hindered such a shift in the past, but as it stands, the current tech standards make mobile payments wildly safer than credit card payments.

So get ready to leave your wallet at home. Your pockets won’t miss lugging around your bulky cash and credit cards anyway…

Leave a Reply