While most traders white-knuckled the sharp equity drop last month, a much bigger (and more important) trend emerged…

In case the market has distracted you, here’s what you’ve missed:

Gold is up nearly 10% on the year…

Silver is up 13%…

After a sharp drop in January, crude oil has risen more than 4.5% since Jan. 1…

Thanks in part to a harsh winter, natural gas has spiked a whopping 31%…

Due to drought concerns, soybeans are up more than 5.5%, while coffee has blasted higher by 38%…

I think you get my point.

2013 was not kind to commodities across the board. Precious metals hit the skids and grabbed most of the headlines—but other commodities also either suffered or stagnated as the year progressed.

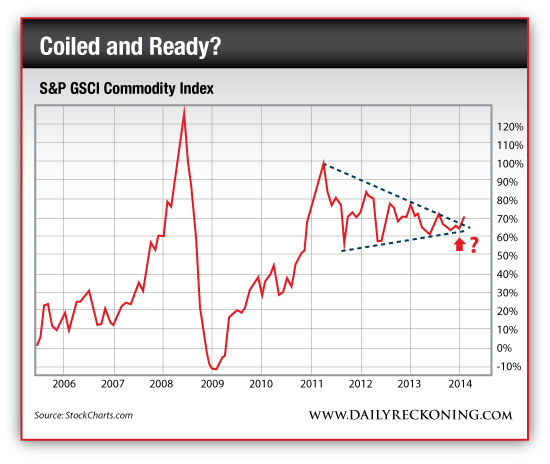

But someone flipped the switch this year, triggering breakout after breakout. If you step back for a bigger picture view, you can see how the S&P GSCI Commodity Index appears to be testing a major breakout zone after a massive 3-year coil…

Remember, commodities (as a group) are still way below their 2008 highs. Many have room to run from here…

There’s one commodity I’ve watched closely for months now. Now, I believe it has finally put in a bottom and is set to scream higher in the coming weeks and months. After a terrible 2013, this could end up as the comeback story of the year when all is said and done.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply