Former Reagan economic adviser David Stockman told The Daily Ticker recently that bubbles abound in a number of frothy U.S. markets. “Junk bonds, [a] trillion dollars this year… We have the housing market riddled with speculators… This is not recovery. This is not a healthy economy. This is just another giant bubble… The Russell [index], for instance, is trading at 85 times trailing earnings.”

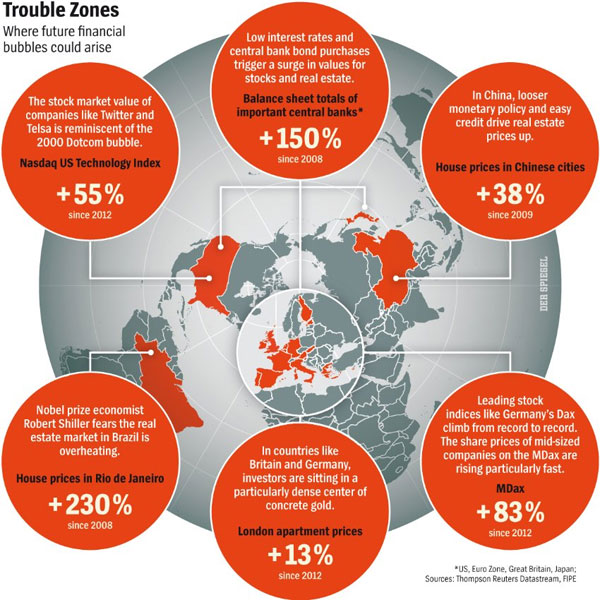

The U.S. may not be the only bubble farm currently planting crops, as this infographic from Der Spiegel indicates.

Last month, Federal Reserve chair nominee Janet Yellen told the Senate that she saw no bubbles amiss in the U.S. economy. “Stock prices have risen pretty robustly… [but] you would not see stock prices in territory that suggests bubble-like conditions.”

Similarly, outgoing Chairman Bernanke is dismissive of the very idea of unsustainable market growth permeating the U.S. economy. “I don’t see much evidence of an equity bubble,” Bernanke told the Senate Banking Committee this February.

We, of course, find this comforting. Maria Bartiromo asked him in 2005, “What is the worst-case scenario if prices come down substantially?” He replied, “I guess I don’t buy your premise. It’s a pretty unlikely possibility. We have never had a decline of house prices on nationwide basis.” Great to see both our great chairman and future chairman in total agreement that we have nothing to worry about.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply