In a recent Vox article, Lorenzo Bini Smaghi raises some questions about the argument that austerity is the main reason why European countries’ growth rates have been so low since 2008. To be fair, he is open to the idea that austerity has done some damage but he suggests that structural issues are also responsible for what we have seen in Southern European countries.

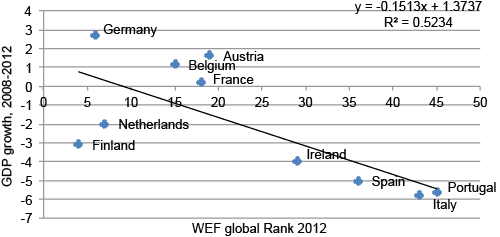

His main argument can be summarized by a set of charts where growth during the 2008-2012 period is shown to be negatively correlated to measures of competitiveness. For example, comparing growth during the crisis with the competitiveness index produced by the World Economic Forum, one gets the following correlation:

So the argument is that the low growth performance of Southern Europe (and Ireland) during the crisis is related to their structural problems.

I will not disagrees with the statement that some of those countries have structural weaknesses that can constraint their growth rates. But I find that the chart above does not provide much insights on how much growth reforms could deliver or the extent to which lack of reforms are behind the depth of the recession in these countries.

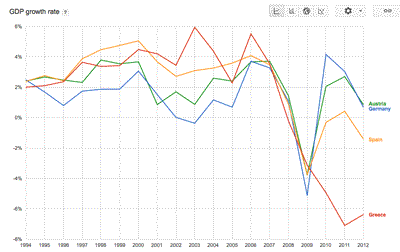

My concern is the use of only 4 years to assess the effects of competitiveness. If structural weaknesses matter so much, they should affect growth in the long term (not just during crisis). If one compares the evolution of GDP growth since 1994 among some of these countries, the picture looks very different.

(click to enlarge)

For every year in the period 1994-2009 (without exception) growth in Spain or Greece was higher than in Germany (and without the exception of 1998 this is also true when compared to Austria). It is only during the years 2010-2012 where Austria and Germany display faster growth rates than Spain and Greece. And it is in those years that austerity was the strongest. So what we have is countries where the amplitude of the business cycle is much larger. They did better during the good years and now they are doing worse, which is not a big surprise (e.g. the volatility of emerging markets tends to be larger than that of advanced economies). And given what happened in those years in terms of austerity and the fact that financial markets remain dysfunctional it is even less of a surprise. No doubt that structural weaknesses exist in these countries but their connection to growth is a complex one and cannot simply be assessed by looking at the last three years.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply