“Short-term U.S. debt prices tumbled again Tuesday amid rising investor concern about the prospect of a government-debt default, sending the yield on one-month U.S. Treasury bills to its highest level since the financial crisis.”

That’s from the WSJ.

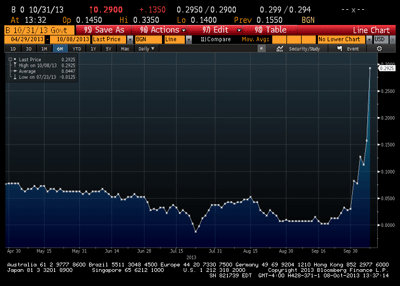

Here’s a graph from Irwin/Wonkblog depicting recent movements in yields.

(click to enlarge)

The WSJ article continues:

In the market for derivatives known as credit-default swaps, which some traders use to bet that a debt issuer will default, investors now are pricing in a 3% probability the U.S. won’t pay its obligations in timely fashion. Traders were asking Tuesday for €58,800 ($79,856) to insure €10 million of U.S. debt for a year, up 9.7% from Monday and up tenfold from Sept. 20 levels. U.S. credit-default swaps trade in euros to help users hedge the risk of a depreciating dollar in the event of a default.

Of course, this could be much ado about nothing (i.e., the markets are misguided regarding risks). As Representative Yoho (R-FL) stated:

“I think, personally, [not raising the debt ceiling] would bring stability to the world markets.”

Much of the belief that there is not much issue with breaching the debt ceiling seems to stem from the belief that interest payments can be prioritized so as to be only in technical default. As many have noted (including the GAO), it’s not clear that either legally or technically such prioritization could be implemented (think about all those government computers still running COBOL [1]…and Treasury makes about 4 million payments per day, many more than undertaken in 1957 when prioritization last occurred).

Finally, even if Treasury were able to implement prioritization, the reduction in spending would exert a contractionary impact on output. How big an impact would depend upon when the Treasury runs out of money and borrowing authority headroom, and how prioritization was implemented (payments to debt subject to debt ceiling, not subject, etc.).

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply