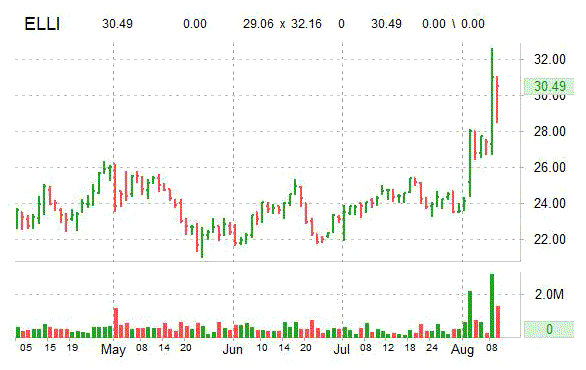

Ellie Mae Inc (ELLI) has been in an uptrend since January 2012, but throughout 2013, and particularly since early June has been moving higher within a well defined rising channel. August 8 marked a break out and a fresh 52-week high for the ticker that surged from $26.72 to $32.61. It closed at $30.98, up $3.61, or 13%, on nearly 3 million shares. This is the best volume this stock has had since Feb. 19. If the push continues, the trend will be accelerating and the name could see $40 or higher in fairly short order.

At $31, next support is at $28.94 and then at $26.19. Unless these key support levels are convincingly penetrated, the buy the dips strategy is still the higher probability trade.

ELLI is up 26% in the last month, up 51% in the last six months, and up $5.05, or 19.85%, since this time last year.

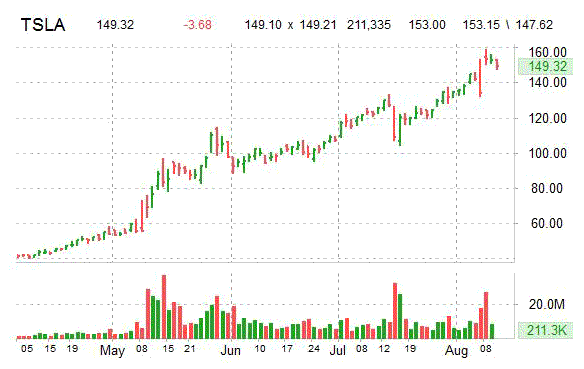

Shares of Tesla (TSLA) continue to hold above $150 after the electric carmaker reported better-than-expected quarterly results. TSLA currently trades 140% above its 200-day MA, giving Elon Musk’s company a market cap of well over $15-billion.

With this stock running the way it is, it may make an upside move up toward the $157 range short-term.

TSLA, which went public in June 2010 at $17 a share, is a buy below $140.

Disclosure: No Positions

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply