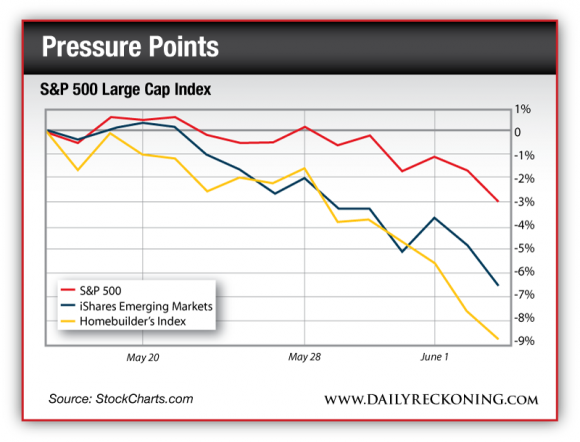

It’s official. The broad market’s 4% off its May highs. That’s the biggest pullback we’ve seen so far this year.

Economic news has changed. At least, the market’s reaction to the news has changed. A poor manufacturing number would go largely unnoticed just a couple of months ago. Investors completely shrugged off bad news and slammed the “buy” button.

But once a little worry sets in, bad news becomes bad once again. And good numbers just aren’t good enough. Any stumbles are magnified by the media as the sole reason for the market’s decline…

So where’s the pain right now?

The broad market has suffered since mid-May. If blood is your thing, you can find some added carnage in emerging markets. They’re down 7% over the same period.Unfortunately, emerging markets don’t even have the benefit of the recent rally’s tailwind. The iShares Emerging Markets ETF hit fresh 2013 lows yesterday. Bummer.

Back in the U.S., housing has become the big freak-out trade. Investors have absolutely shellacked the S&P Homebuilders Index. It’s down 9% since mid-May, doubling up the broad market’s losses.

All this tapering talk has investors thinking the housing market might call it a year. A sharp drop-off in mortgage applications isn’t helping the cause, either…

“Applications for home loans dropped 11.5 percent from a week earlier,” the Associated Press reports. “The decline came as mortgage rates rose. The rate for a 30-year fixed-rate mortgage rose to 4.07 percent last week from 3.90 percent.”

That’s enough to spook the socks off anyone betting on housing right now. However, it will take a little while before the effects are actually felt. Also, it’s important to remember that housing stocks have jumped all over the place this year. The overall trend is higher. But it’s been sloppy. This week marks the third time the S&P Homebuilders Index has slipped below its 50-day moving average this year. No one ever said it would be a smooth ride…

Overall, the next few days are critical for the major indexes. If we don’t see a bounce at these levels, it will be time to map out some different scenarios for the markets this summer. On the bright side, futures are holding onto their gains after the jobs data early this morning.

Still, it’s important for you to stay nimble. Sentiment is fragile right now. It won’t take much to change the market’s short-term course as we head toward the end of the week.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply