Technology from innovative companies in Silicon Valley—think Apple (AAPL), Google (GOOG), Amazon.com (AMZN) and Facebook—has permeated our workplace and home. As one tiny example, what startup company provided the smartphone, computer or even printed version allowing you to read this blog right now?

Experts analyzing Silicon Valley’s economic power use Apple as an example: Two poor, hard-working guys had the freedom to set up shop in a garage, and by pure ingenuity and skill and creativity, grew their company to become one of the most highly respected businesses in the world. Apple employs more than 64,000 people today and, in its most recent fiscal year, generated $180 billion in revenues, with more than $80 billion in cash on its books.

Richard Florida of The Atlantic recently praised Silicon Valley’s entrepreneurial spirit, declaring that “the very essence of America’s economic and cultural DNA is its ability to generate ever-new generations of startups…startups that forever shift the nation’s whole economic structure.”

This economic and cultural DNA is difficult to reproduce elsewhere, says essayist and author Paul Graham. There are many advantages to starting a business in the U.S., including an open immigration policy, excellent universities, a large domestic market, and venture funding. He says what stops other countries from having their own version of Silicon Valley are obstacles such as rigid labor laws, bureaucratic hassles, regulations and access to debt instruments.

Similar hindrances seem to have sprouted in the U.S. in recent years in the form of regulations. Per the Small Business Administration (SBA), the cost of federal regulations stands at $1.75 trillion, or more than $8,000 per employee. Small businesses bear a disproportionate share of the federal regulatory burden as companies with fewer than 20 employees have a cost per employee that is a third more than larger companies, according to data from the SBA.

Many argue these new regulations have not only constrained companies and made them less profitable—or in some cases, prevented businesses from starting—but they also have shifted wealth from Main Street and Wall Street to K Street. Business is booming for consulting and lobbying firms in the Washington D.C. area, where Bloomberg News reported that an associate attorney with one to eight years of experience can bring home a median salary of $186,250 a year. This is about a third more cash than the median peer earns outside of D.C.

These elevated salaries have helped the D.C. area become the wealthiest metropolitan area in the U.S. this year, overtaking the aforementioned Silicon Valley, according to the U.S. Census Bureau.

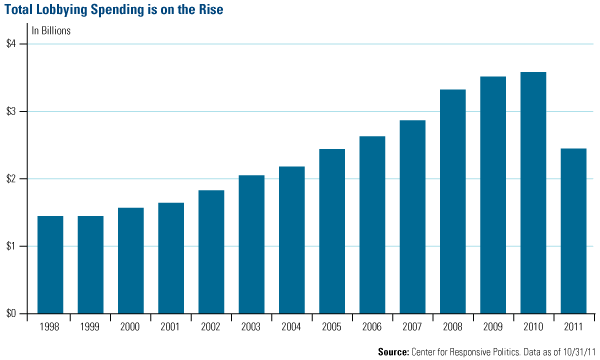

The number of lobbying firms on Capitol Hill has increased 30 percent since 1998, says the Center for Responsive Politics. Below shows how lobbying spending has also steadily increased over the past several years with a record $3.5 billion spent in 2010.

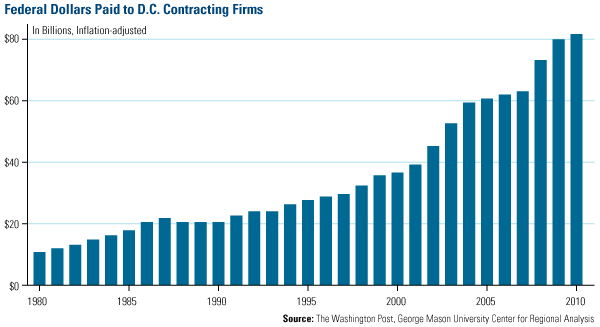

Another booming business is contracting firms. In “Government dollars fuel wealth: D.C. enclaves reap rewards of contracting boom,” The Washington Post stated that the government “remains an engine of job creation, outsourcing its tech support and other services.” In 2011, “more than $80 billion in federal contracting dollars will flow to the region,” says the newspaper. Money to contracting firms has steadily risen over the past three decades, but has shot up significantly in the last 10 years. Adjusting for inflation, this record-high 2011 figure is seven times higher than it was in 1980.

Lately, there have been some rather deflating opinions about the U.S. At the CLSA AsiaUSA conference I attended in November, U.S. pollster and author Frank Luntz shared his proprietary method of defining American sentiment. When he asked, “Which word or words describe how you feel about living in America today?” he found that Americans are more worried and frustrated and are feeling less confident and successful.

Luntz’s findings are supported by a recent Pew Research Center survey which showed Americans aren’t as confident in the country as they have been in the past. Pew polled people around the world, asking if they agreed with the statement, “Our people are not perfect, but our culture is superior.” In 2002, 60 percent of Americans polled agreed with this statement. Today, only 49 percent of people believe in this superiority.

What’s most alarming about Pew’s findings is that only 37 percent of U.S. citizens aged 18 to 29 believe in this statement. This is the age bracket Steve Jobs and Steve Wozniak fell in when they started Apple.

The reasons for increasing pessimism vary depending if you ask a republican or a democrat, or a supporter of the Occupy Wall Street or the Tea Party, but I believe it’s not about political parties, but political policies. In Florida’s article, he questions if readers would rather have a “dynamic, innovative, self-revolutionizing” economy, or a “staid and static one, built around older and potentially more vulnerable industries?”

My guess is that many people would opt for the first choice. The entrepreneurial spirit is what makes the U.S. special and provides a template emerging countries look to follow. For America to remain an incubator for the world’s best business, technology and inventive ideas, we believe that policies that promote prosperity must be put in place.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

The short answer is NOTHING. You’re going down the drain like the rest of us!