Technology companies have seen a strong recovery in the last year and Itron Inc. (ITRI) is no exception. Earnings are expected to rise 88% compared to 2009 when the global recession was hitting software companies hard. With a low P/E, this growth gives Itron a juicy PEG ratio of just 0.7.

Itron specializes in software and data collection solutions to the energy and water industries which is a hot area as utility companies upgrade to automated meter reading systems. Its products include electricity, gas, water and heat meters.

Itron Had a Record Third Quarter and 9-Months

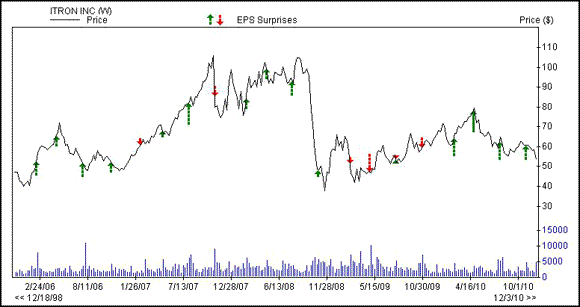

How good are things at Itron? On Oct 27, it reported its third quarter results and easily blew by the Zacks Consensus Estimate by 25%. It was the fourth consecutive earnings beat.

This is a turnaround from the height of the recession, where the company saw numerous misses on estimates and the stock sank.

Earnings per share were $1.06 compared to the Zacks Consensus of 85 cents.

Revenue jumped 41% in the third quarter to $576 million from $408 million. For Itron the big story behind the record quarter wasn’t in the hot emerging markets, it was the growth in North America.

Revenue soared 130% in the quarter to $315 million due to higher shipments of smart meters and modules. North American revenue was also up 105% for the first 9 months of the year.

In the International division, revenue fell 4% to $261 million mainly due to changes in foreign currency exchange rates as meter volumes were higher.

The Backlog and New Order Bookings also increased year over year. Total backlog at the end of the third quarter was $1.7 billion compared with $1.6 billion last year.

New order bookings for the third quarter jumped to $528 million from $400 million in the third quarter of last year.

Zacks Consensus Estimates Rise

Not surprisingly, given the big beat and optimism going forward, analysts have been raising full year estimates. In the last 60 days, the 2010 Zacks Consensus has jumped to $4.02 from $3.66 per share.

For 2011, so far, analysts see a slowing of the earnings growth to just 7.5%. The 2011 Zacks Consensus has risen to $4.33 from $4.09 in the last 2 months.

Itron made just $2.14 in 2009 so it is more than a doubling of earnings in just a 2 year time.

Itron Has the Powerful Combination

A value stock with a high earnings growth rate is a very powerful combination. Itron is trading with a forward P/E of 13.4, which is under its peers at 15.4x.

Given the low P/E and double digit earnings growth rate, Itron’s PEG of 0.7 is well under that of its peers at 1.0.

Itron is a Zacks #1 Rank (strong buy) stock.

ITRON INC (ITRI): Free Stock Analysis Report

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply