On your marks…get set….go!

Markets are off to the races so far this morning, as all manner of risky assets on Macro Man’s screens have roared higher. It almost feels as if markets, having successfully survived the murderer’s row of event risks last week, exhaled over the weekend and decided that plan A (liquidity-driven uber-rally) wasn’t so bad after all.

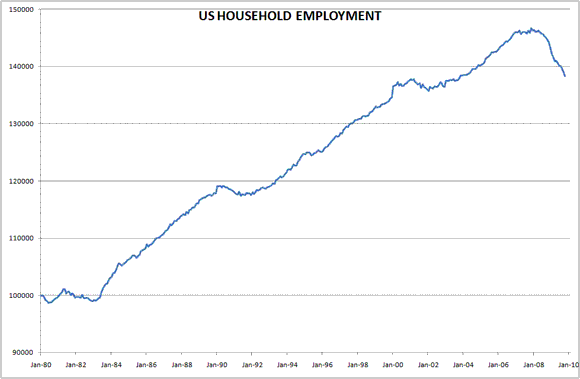

For if markets “wanted” to head lower, they surely could have. Friday’s payroll report was an ugly one beneath the veneer of a largely in-line “number of jobs” figure. The household data, for example, was pretty appalling, continuing the divergence observed in this space on Friday. Sometimes, it’s useful to look at data in its simplest form; readers are invited to reach their own conclusions as to what the chart below implies moving forwards.

Similarly, the latest Krishna Guha article with the impressive St. Louis Fed president, James Bullard, suggests at least some voters do not wish to repeat the mistakes of the not-too-distant past.

On some days, that perhaps might have been enough to send markets reeling. Not today, however, which is instructive. Perhaps markets are relieved that the G20 accomplished nothing of consequence? That Gordon Brown’s proposal to tax the very air you breathe financial transactions received short shrift from Lil’ Timmy?

Or have they been swayed by the IMF report that the US dollar is potentially being used as a funding currency? (A little-known codicil to the weekend report also noted that the sun would rise in the east, observed that ice cream is cold, and forecast that the Pittsburgh Pirates would not win next year’s World Series.)

In any event, it is worth observing that among the star performers in recent days have been Asian currencies; the ADXY is nearly back to its October highs. Macro Man notes this because Asia was really the first “risk asset market” to roll over, a week before the fateful Guha article appeared in the FT on October 23.

(click to enlarge)

You don’t have to be a chartist to think that after a healthy correction, if we make a new high then it really could be off to the races….

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply