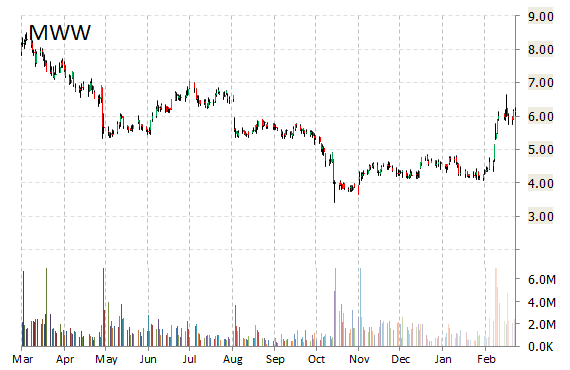

In a report published Thursday, B. Riley & Co. analysts initiated coverage on Monster Worldwide, Inc. (MWW) with a ‘Buy’ rating and $10.00 price target.

On valuation measures, Monster Worldwide, Inc. shares currently have a PEG and forward P/E ratio of 1.35 and 10.24, respectively. Price/sales for the same period is 0.73 while EPS is ($3.29). Currently there are 3 analysts that rate MWW a ‘Buy’, 5 rate it a ‘Hold’. No analyst rates it a ‘Sell’. MWW has a median Wall Street price target of $6.65 with a high target of $8.50.

In the past 52 weeks, shares of Weston, Massachusetts-based online and mobile employment solutions provider have traded between a low of $3.41 and a high of $8.50 and are now at $6.33. Shares are down 23.51% year-over-year ; up 33.12% year-to-date.

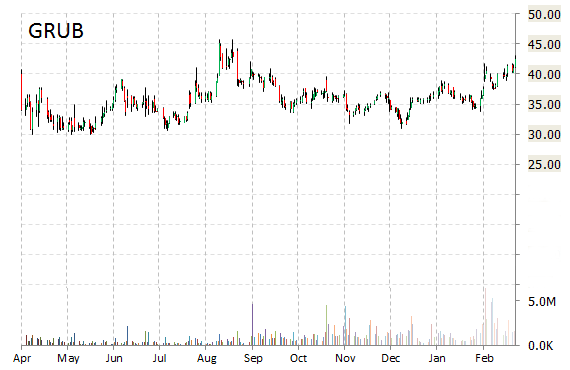

Investment analysts at Morgan Stanley (MS) initiated coverage on shares of GrubHub Inc. (GRUB) in a note issued to investors on Thursday. The firm set an ‘Overweight’ rating and a $50.00 price target on the stock. The firm’s price target would suggest a potential upside of 19% from the stock’s current price of $42.17.

GrubHub Inc., currently valued at $3.44 billion, has a median Wall Street price target of $49.00 with a high target of $54.00. Approximately 907K shares have already changed hands, compared to the stock’s average daily volume of 1.64M.

In the past 52 weeks, shares of the clinical-stage biopharmaceutical company have traded between a low of $29.86 and a high of $45.80 with the 50-day MA and 200-day MA located at $37.74 and $36.94 levels, respectively. Additionally, shares of GRUB trade at a P/E ratio of 1.21 and have a Relative Strength Index (RSI) and MACD indicator of 67.89 and +1.97, respectively.

GRUB currently prints a year-to-date return of around 16.90%.

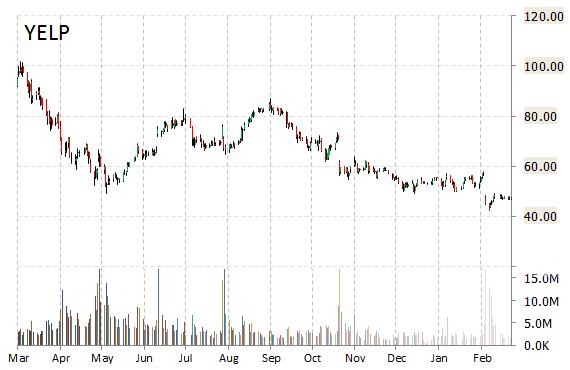

Shares of Yelp, Inc. (YELP) are up $1.44, or 3.06%, at $48.59, after Morgan Stanley (MS) analysts today initiated coverage of the name, giving it an ‘Overweight’ rating and price target of $62.

On valuation measures, YELP shares are currently priced at 101.38x this year’s forecasted earnings, which makes them expensive compared to the industry’s 19.20x earnings multiple. Ticker has a forward P/E of 89.80 and t-12 price-to-sales ratio of 9.07. EPS for the same period is $0.48.

In the past 52 weeks, shares of San Francisco, California-based firm have traded between a low of $42.10 and a high of $101.75. Shares are down 50.21% year-over-year and 13.85% year-to-date.

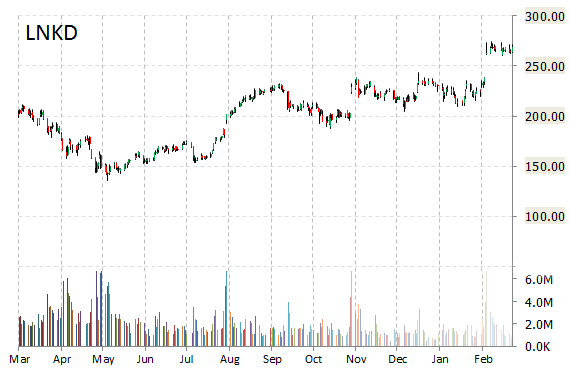

Morgan Stanley (MS) is out with a report this morning initiating coverage of LinkedIn Corporation (LNKD) with an ‘Overweight’ rating and $310 price target, implying 13.50% expected return.

In the past 52 weeks, shares of LinkedIn have traded between a low of $136.02 and a high of $276.18 and are now trading at $272.93. Shares are up 28.19% year-over-year and 17.10% year-to-date.

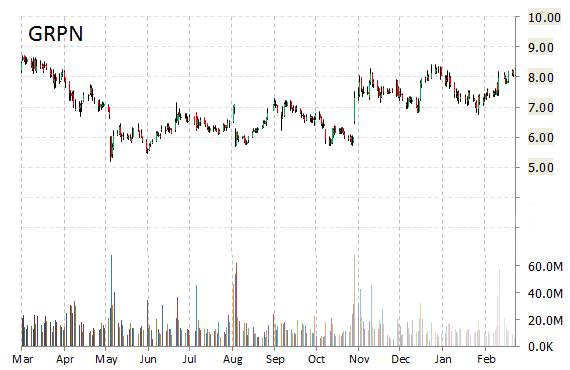

Morgan Stanley (MS) initiated shares of Groupon, Inc. (GRPN) with an ‘Equal-Weight’ rating and set a $9.00 price target on the name. Right now, the stock is sitting at $8.17, a 0.90% loss, and is 0.36% lower year-to-date, compared with an 14% gain in the S&P 500.

Groupon, Inc. closed Wednesday at $8.26. The company has a total market cap of $5.52 billion.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply