While the market pundits try to leapfrog each other with their latest bubble guesses, I have more important issues on my mind.

Bust out your best Jerry Seinfeld voice for this one:

What’s the deal with small stocks?

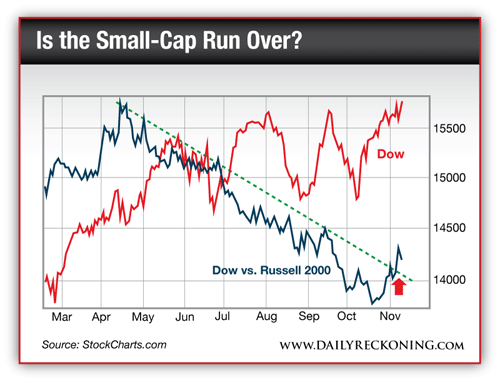

After some erratic trading over the past week or so, we’re witnessing some serious market rotation. Specifically, high-flying small-caps are beginning to cool off, while the Dow is finally starting to play catch-up with the rest of the market.

Yes, the Dow Jones Industrial Average posted a new high yesterday… finally. The big boys are back—and it appears that their 7-month streak trailing the performance of the Russell 2000 small-cap index has come to an end…

The shift away from small stocks makes sense right now. The Russell 2000 has trounced the major indexes so far this year. It’s up nearly 30% year-to-date as of yesterday’s close. Keep in mind, the Russell is still off its October highs, too.

After last week’s nasty market action, investors are picking through the laggards and looking for a little safety. A lot of the bigger stocks are catching a bid, with quite a few Dow components breaking to the upside to help the Big Board play catch-up.

While this isn’t exactly how I expected the year-end rally to play out, you should have no trouble taking advantage of the rotation.

If you’re nimble and willing to shift your focus as a rally evolves, you’ll have no trouble pulling gains out of this market as Turkey Day quickly approaches…

Leave a Reply