Last night Larry Summers pulled his name from consideration to replace current Federal Reserve Chairman Ben Bernanke, ending what had become a very contentious nomination process. The Obama Administration badly miscalculated the strength of the opposition to Summers, and erred further by floating his name well before they intended to nominate him for the post, providing plenty of time for his detractors to chip away at him.

Markets look to be welcoming the news, certain now that current Vice Chair Janet Yellen will get the call to fill Bernanke’s shoes. Whether this is true or not remains to be seen. I still believe she is the best candidate running (putting aside names like Christina Romer and Stanley Fischer), and agree with Ezra Klein when he says the President would be petty to toss Yellen aside at this point. That said, I cannot discount that possibility. I have tended to believe in the thesis that this would be a case of mutually assured destruction for both Summers and Yellen – that Administration insiders would blame Yellen’s supporters for tanking their candidate. The path for Yellen’s nomination would be easier had not her supporters focused on her as the sole alternative to Summers. Even smoother still had not the Administration engaged in a whispering campaign against Yellen in the first place. The Administration is going to need to sallow some pride to nominate Yellen. Let’s hope they do.

The market reaction stems from the belief that Summers is a hawk and Yellen is a dove. While I understand that this is a widely held belief, I think it is insulting to both candidates to paint them with such broad strokes. I think that either candidate would be hawkish or dovish as the situation required. I also think that if you believe Yellen is an unabashed dove, you are going to be surprised by her reaction if inflation rears its head in the slightest.

Indeed, I think that Brad DeLong has it right here – if you are looking for a candidate of change, Yellen isn’t that candidate:

One very powerful technocratic reason to prefer Summers over Yellen was that he would look at the Fed’s current policy dilemmas with fresh eyes, while she is strongly invested in the belief that the policies that have produced the current outcome–1.2%/year inflation, 7.3% unemployment rate, 58.6% civilian employment-to-population ratio–are the best the Federal Reserve can do.

Remember that Yellen was part of the team that cemented the Fed’s inflation target in place at 2%. She has a long history of supporting inflation targets. To truly enact a regime change at the Fed, you need to find a Chair that will challenge that target and rewrite the rules. I am not sure Yellen is that person. But at the same time I also agree with Brad:

That said, the other candidates on the short list are even less inclined to adopt the policies the U.S. economy needs right now. And there are powerful non-technocratic reasons–breaking glass ceilings, not making every decision a kick in the face directed at the left wing of your coalition–for choosing Yellen as well.

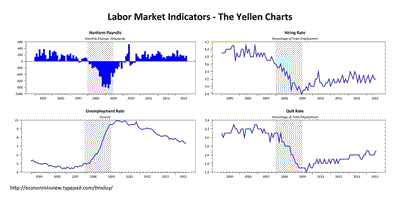

She is the best candidate on the short list. I just think it is premature to claim that she would pursue a decidedly more dovish policy than Summers. For a more concrete example, where does Yellen sit on the tapering debate? He haven’t heard from her since a speech on regulation on June 2, before Bernanke’s tapering conference. But we do know her definition of “substantial” improvement in the labor market from a March 4 speech. She lays out five indicators, four from the labor market:

(click to enlarge)

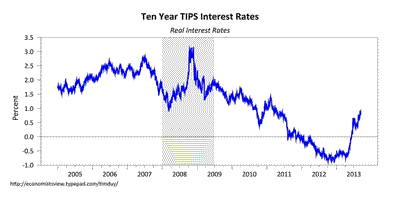

and general spending and growth in the economy. To be sure, she noted that unemployment and job growth were the most important. Still, if you were following these indicators, I think it is reasonable to conclude that only the unemployment rate has significantly improved since March, and only then on the back of declining labor force participation rates. Yet we are walking into the FOMC meeting this week with the general belief that the beginning of the end for asset purchases is on the table. Moreover, regardless of the outcome, the damage is done as the FOMC has clearly moved in a more hawkish direction:

(click to enlarge)

Where was Yellen in all of this? Shouldn’t her supposedly dovish voice have been pushing back against this hawkish turn of events? Or is she part of the status quo, largely in agreement or just not sufficiently motivated to push back? None of this is meant to challenge Yellen or her worthiness for the position, but only to challenge the assumption that she will pursue a more dovish policy that Summers. If the case against Summers was that he was not 100% committed to quantitative easing, you really need to take that into context of an current FOMC that is not 100% committed, and indeed has laid out an explicit plan to end the program without Summers on board.

Bottom Line: Summers is out. Is Janet Yellen in? She should be, but we have already made the mistake once of believing she is the front-runner. Initial market reaction will be positive based on the belief that she can be caricatured as a dove. I don’t think this will necessarily be so evident a year from now.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply