Reuter’s Christopher Swann says yes. He explains the nature of the current deflationary pressures and argues it still poses a threat:

The current variety of deflationary pressure… stems not from efficiency savings but rather from weak demand. Worse still, it is accompanied by record levels of debt.

Despite frantic efforts to pay off loans, household debt is still around 130 percent of disposable income. This was precisely the combination that Irving Fisher warned about in his celebrated 1933 article on debt deflation.

Under these conditions, the rising real value of debts encourages households and businesses to sell their assets to pay down loans. As fire sales reduce asset prices — stocks and property — real net worth declines further. Output and employment decline, accelerating the slide in prices.

…

So we are right to be afraid of deflation — very afraid. It still has the potential to sap energy from the American economy for years to come.

The Federal Reserve is preparing to lay down its unorthodox monetary policy instruments. But it may have to dig deep into its tool box before too long if deflation takes hold.

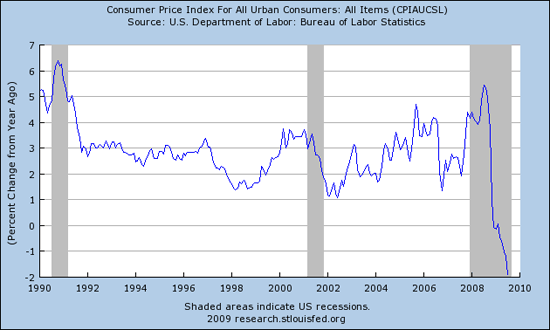

Swann cites research in the piece that core inflation is overstated by 1%. Headline CPI inflation on a year-on-year basis has been negative as can be seen in the graph below.

TIPs securities, however, show an expected average rate of inflation over the next 5 years that is positive at about 1.3%.

One thing I like about Swann is that he takes the time to explain why today’s deflationary pressures are harmful–they are driven by a collapse in aggregate demand–and different than the more benign deflationary pressures that occurred earlier in the decade–they were driven by an increase in aggregate supply. This is the view I hold as noted here and here. Finally, note that the fundamental problem here is not deflation per say but a collapse in nominal spending. That is why we need more than ever a nominal income targeting rule.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply