Revisions to some of the key indicators bring us back to the same old story– the U.S. economy continues to grow, but at a slower rate than any of us would like.

The Bureau of Economic Analysis released on Thursday a revised estimate that U.S. real GDP grew at a 2.7% annual rate in the third quarter, up from the initial estimate of 2%. So things are better than we thought? Not really.

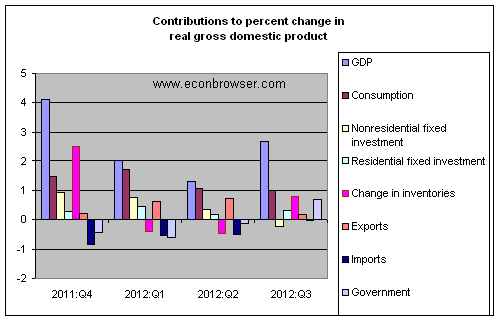

The revised figures do show an improvement of 0.4 percentage points in the contribution of exports, which are now claimed to have added about 0.2 percentage points to the 2.7% growth figure instead of subtracting 0.2% as originally reported. But this was erased by a 0.4 percentage point reduction in the contribution of consumption spending. More than all of the reported improvement from 2% to 2.7% GDP growth could be attributed to a higher rate of inventory accumulation than previously estimated. To put it another way, real final sales for the third quarter were originally reported to have grown at a 2.1% annual rate, whereas the new numbers have the figure at only 1.9%. The bottom line is that growth in demand for U.S. goods and services overall remains weak, even weaker than originally reported.

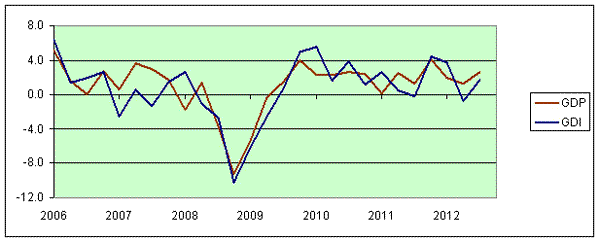

The new BEA report also gives us the first look at an alternative estimate of third-quarter GDP that is built up from separate data on the income people are earning rather than goods and services being produced. Conceptually, an estimate of GDP constructed using either method should produce the identical number. But in practice, one arrives at different numbers using different data sources. With this second GDP release, the BEA begins to report the “statistical discrepancy” between these two calculations. Fed economist Jeremy Nalewaik maintains that if one subtracts this statistical discrepancy from reported GDP, the resulting series (sometimes referred to as gross domestic income, or GDI) may offer a slightly better indicator of the state of the economy, particularly around business cycle turning points. The bad news is that, according to GDI, the U.S. economy only grew at a 1.7% rate in the third quarter and actually fell at a 0.7% rate in quarter 2. My personal preference is to average the GDP and GDI growth rates, which calculation would tell us the U.S. economy grew at a 0.3% rate in the second quarter and 2.2% in the third, with about 0.8 percentage points of the latter representing inventory accumulation.

Quarterly growth of real GDP and real GDI, quoted at an annual rate, 2006:Q1-2012:Q3.

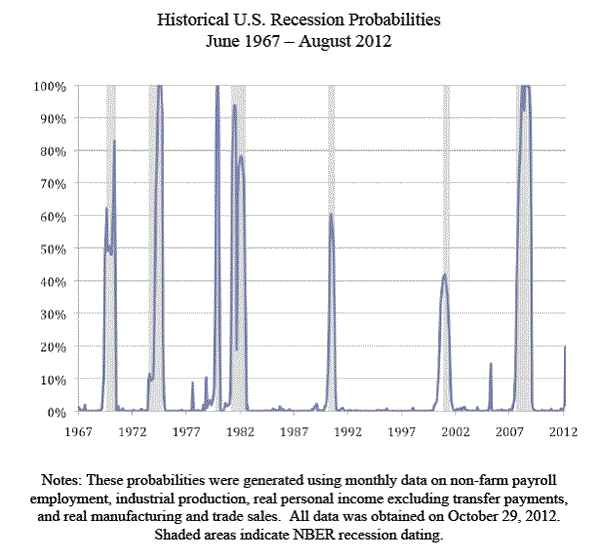

Another important and more favorable set of revisions were those accompanying the BLS employment report released at the start of November. In addition to reporting healthy job growth for October, this report revised up the numbers initially given for September and August. I predicted that these employment revisions would in turn lead to a substantial revision in the recession probability index maintained by University of Oregon Professor Jeremy Piger, and indeed they did. Perhaps you remember this graph, which represented the value of this index based on data available as of October 29, and was subject to widespread misinterpretation.

Recession probabilities calculated on October 29, 2012. Source: Piger, Oct 29.

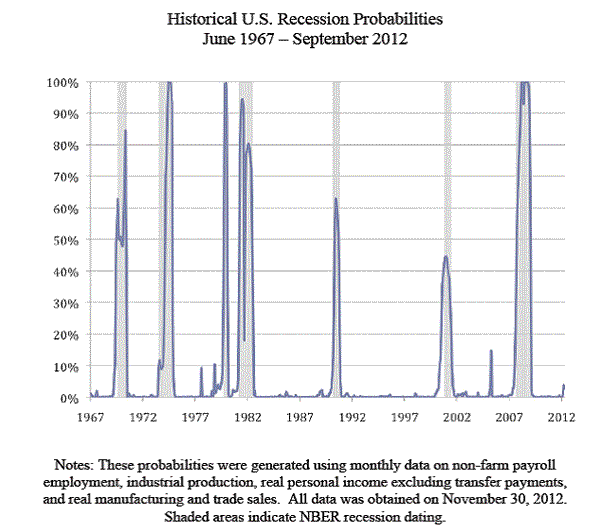

Professor Piger has just updated this chart, and here’s what it looks like today:

Recession probabilities as calculated on November 30, 2012. Source: Piger, Nov 30.

I wonder how many of the outlets that trumpeted the first figure will now be faithful and objective enough to report the update?

Similarly to the GDP-based Econbrowser Recession Indictor Index, Piger reports the inference with a 2-month delay to allow for data revisions and trend recognition. For example, the first figure above used data through October 29 to calculate where the economy was as of August. However, that inference is influenced by the data on hand as of October 29, which showed weak employment growth for August and September. As new, more favorable data for August, September, and now October became available, the inference about August became more optimistic. Note that, by contrast, the Econbrowser Recession Indicator Index (currently at 7.9%) is intended as a pure real-time summary and is never revised.

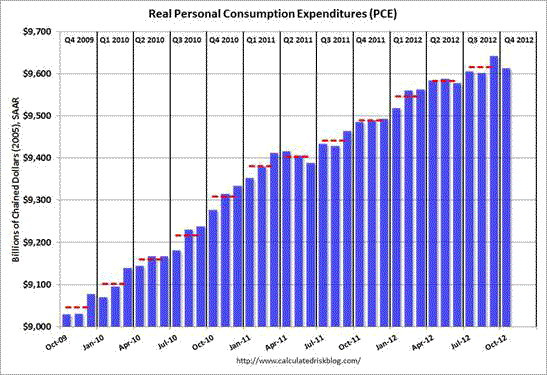

But some weaker data may be in store for us. Hurricane Sandy ([1], [2]) may well depress the next employment report due out Friday. Last week’s Regional manufacturing surveys and various housing measures all suggested some weakening, and consumption spending is starting the fourth quarter down from the month before.

Source: Calculated Risk

Then there’s the fiscal bluff. I am not optimistic this is going to be resolved before January, and worry that the uncertainty itself is starting to affect the investment and hiring decisions of firms uncertain about their sales and spending decisions by consumers uncertain about their taxes.

So my expectation is that below-average growth rates for the U.S. will continue.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply