Deutsche Bank’s Computer Services & IT Consulting analyst Bryan Keane is putting his weight behind Computer Sciences (NYSE:CSC) this AM upgrading the stock to Buy from Hold with a $46 price target.

– This is one of the most strongly worded calls of late.

In 10+ years covering the IT Services industry, they have seen many blow ups and recoveries, and this recovery/plan is setting up as one of the best, Keane tells his clients. He notes they wanted to track a few quarters of the recovery to be sure the correct management team and plan was in place, and they are now convinced that CSC will make a full recovery and come out an even better company after the turnaround is complete. Currently, the stock’s valuation reflects depressed profit levels, which does not take into account the company’s true normalized earnings power, in their view. Although Street sentiment remains overly negative, they believe better-than-expected results (faster-than-anticipated turnaround) will begin to turn the tide more positive.

After faltering significantly in FY12 on lax contract oversight, faulty financial controls, resource mismanagement, and a long-running failure to recognize major shifts in the IT services industry, CSC has arguably turned into a viable turnaround story after instilling new management, redressing its cost structure, and altering its strategic focus. New CEO Mike Lawrie and CFO Paul Saleh have begun to create a culture centered around contract profitability and streamlined operations, changing CSC from a fragmented holding company to a disciplined operating company and rewarding shareholders with higher operating margins and EPS growth as a result. Deutsche believes the turnaround is happening faster and normalized EPS of $5.00+ will be reached earlier than expected (current valuation does not reflect future normalized earnings), warranting multiple expansion to 14x CY13 EPS (shares currently trade at 10x). If they see the full amount of cost saves realized by FY14, Deutsche believes there could be material upside to their EPS expectations. Long term, CSC believes it can achieve and sustain 3-5% top-line growth and 15% EPS growth.

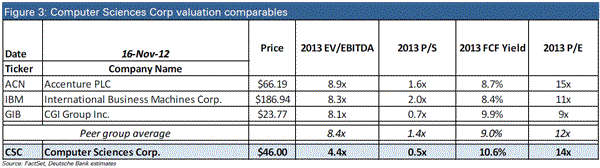

Deutsche sees Accenture, IBM, and CGI Group as CSC’s true comparables in light of their similar business models and margin profiles. As investors generally focus on top-line growth, operating margin expansion, and earnings growth to value multinational IT services companies, the firm believes their target multiples are fair as CSC returns to industrylevel top-line growth while expanding its operating margins to grow EPS. They believe CSC’s multiple could catch up to its peer group average should it achieve industry topline growth and operating margins levels on par with peers earlier than expected.

CSC currently trades at a significant discount to peers even at depressed EBITDA levels (trades at only 3.5x CY13 EV/EBITDA versus peer group of 8.4x). Deutsche is raising their FY14 EPS est $0.29 to $3.51 (above Street) and issuing FY15 EPS of $4.00, believing these figures could prove conservative.

Notablecalls: It’s certainly lovely to see an analyst have such conviction in a name. Byrne has done a resonably good job covering the name (he went from Sell to Hold in Oct ’11) and is now really pounding away the table.

The stock shot as high as $38/share 10 days ago when they reported better than expected numbers which means the trend is up. If they were willing to buy it there, they will be more than happy to buy it several points lower on this upgrade.

Note how Keane sets a $46 price target while hinting that if the stars really align for the co, this will be a $70+ stock as valuation catches up to sector. Should create ample buy interest.

I’m thinking this one will trade to $36+ in the near-term. Use scale-in approach if possible.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply