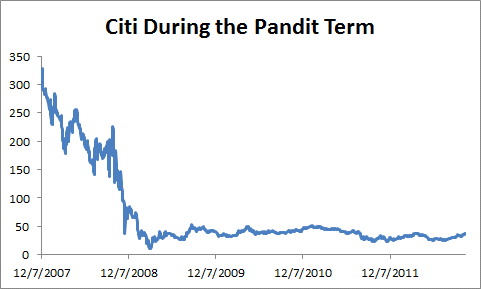

Below is the stock price over Vikram Pandit’s CEO tenure. He received $1 in 2009 and 2010, but then you knew he would make that up and so in March 2011 he was given a $23MM ‘retention award’. As CEO, he has a lot of power so it’s hard to avoid this, and to me it highlights the problems of allocating incentives and rights in large collectives. While I’m a critic of these poor CEOs getting large payouts, I don’t think the solution is obvious. After all, Clinton’s millionaire tax in circa 1994 gave birth to the stock option boom that probably exacerbated the tech bubble and the fraud in companies like WorldCom and Enron.

A lot of people find Pandit’s pay extremely annoying as if Pandit is taking their money, but unlike government money, this is other people wasting their own money. Sure, Citigroup (C) was backstopped in the bailout, but 1) they couldn’t have refused it 2) they paid it all back and 3) that’s not a reason to regulate Citi more, rather, to not bailout big banks. The solution to bad regulation isn’t more regulation, but less. It’s not only creates more efficient incentives and allocation of risk and capital, but is far easier to implemented.

For example, the latest regulatory proposal actually targets spreadsheets:

The regulator stated that insurance firms will be expected to demonstrate appropriate controls with regard to key internal data flow systems such as spreadsheets. These controls should take the form of, among others, input validations, change and release management, disaster recovery and documentation.

They might as well validate my Post-it notes too.

Back to Citi, I think the best way to increase value there is to break it up into into manageable pieces. One simply can’t manage something that big, as the big banks are demonstrating.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply