The summer economic meme seems to be improvement in manufacturing, no good news on real estate and bouncing along the bottom for employment.

Economic Gauges

The Philly Fed said that its index rose to 4.2 in August from a negative 7.5 in July. That’s the highest reading since November 2007. All of the sub-indexes were positive with the exception of, you guessed it, the employment index, though it did get less worse going from a -25.3 to a -12.9.

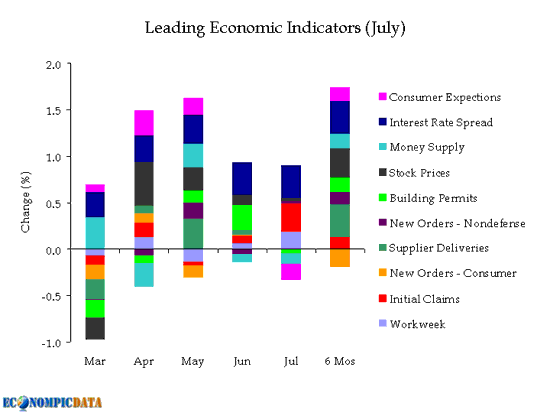

The index of leading economic indicators rose 0.6% which is the fourth month in a row that index has been up. From Jake at EconompicData.com, here is a graphic representation.

Mortgages

Problems in the single family home market are not getting any better at all. The Mortgage Bankers Association reported that 13.6% of single family home mortgages were either at least one payment past due or in foreclosure. Foreclosure starts were pretty much flat which would be encouraging if that number meant anything but given foreclosure moratoria in various states, the data is too muddied to make much out of it.

The pain is not distributed evenly. Consider this and thank God if you don’t happen to live in one of these states:

In Florida, 22.8% of mortgages outstanding were delinquent at least one payment or in foreclosure. Other poor performing states include Nevada, where 21.3% of mortgages were delinquent or in foreclosure, Arizona, where 16.3% were delinquent or in foreclosure, and Michigan, where 15.3% were delinquent or in foreclosure.

Employment

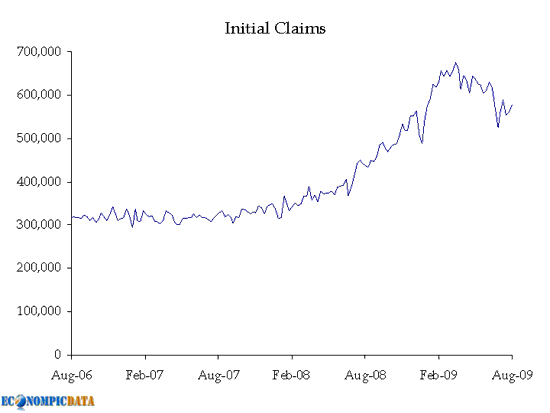

New claims for unemployment insurance jumped 15,000 to 576,000 last week. The four-week moving average was also up 4,250 to a level of 570,000. These are seasonally adjusted figures and they were not expected to move in this direction.

Once again from Jake, here’s a pictorial of the numbers:

Like I said, the same old story. Some pickup in manufacturing but the consumer continues to get slaughtered. If the blip up in the Philly Fed, leading indicators and some other similar positive signs don’t amount to more than just inventory restocking then this entire recovery story might well crash and burn this Fall.

The employment and housing numbers aren’t going to sit well at all with the political class. If things aren’t starting to look up within a month or so, expect some major moves on stimulus. The natives aren’t just getting restless, they’re the ones taking it on the chin.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply