Deutsche Bank’s Semicap Equipment team is making a sizable negative call in the space saying they see downside risk to expectations of robust foundry spending environment in 2013.

Firm is downgrading:

– KLA-Tencor (NASDAQ:KLAC) to Sell from Hold with a $44 price target (prev. $56)

– ASML Holding (NASDAQ:ASML) to Sell from Hold with a EUR 35 price target (prev. EUR 40)

Overall Thoughts

Deutsche sees downside risk to expectations of robust foundry spending environment in 2013 and believes uptick in memory spending would not be sufficient to offset potential foundry weakness driving downside risk to consensus view of flattish WFE spending outlook for 2013. Although bookings momentum could likely remain strong for select WFE names in 1H13, recent positive share price momentum suggests this view is likely discounted in semicap stocks. Moreover, mgmt teams have already been calling for seasonal pick-up in foundry spending from later this year and as such, the firm views the set-up as less favorable for semicap stocks.

End of Foundry 28nm Bookings Era

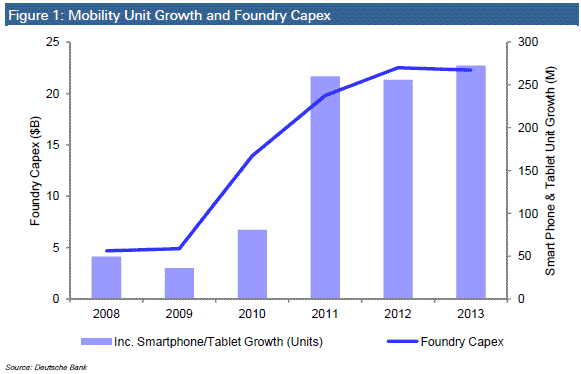

Peaking smart device momentum, stagnating die size growth along with ~75-80% completion of peak 28nm capacity adds exiting 2012 timeframe suggest 2013 foundry spending could potentially decline 15-20% YoY versus current expectations of flat to up 10%. With 28nm foundry capacity potentially reaching 230-250k wspm exiting 2012 and peak 28nm capacity less likely to exceed 275-300k wspm they see increasing risk of a much more muted foundry bookings environment in 1H13 and do not expect potential increase in 20nm spending to offset 28nm spending decline. Even in a scenario where strong 1H seasonality experienced by the foundries plays out in 2013, the firm sees a sharp decline in 2H13 foundry bookings.

1) Growth rate of mobility devices may have peaked in 2012

Strong growth of mobility devices has been one of the primary growth drivers for the foundry sector. Deutsche agrees that mobility devices growth would likely continue over the next few years. However, when it comes to the chip capacity required to build these devices, they believe there is an important misconception in the market – it is not the absolute number of smart devices built that drives the required silicon wafer capacity.

2) Die size growth is also likely stagnating

In addition to device unit growth, another common argument driving foundry spending optimism is the perception that die sizes have been increasing over the past few years and would continue to increase going forward. The majority of discussion about die size growth has been extrapolated from the fact that over the past 3 years, die sizes for Apple’s application processor chips for the iPhone and iPad have grown from 53mm2 (the A4 chip) to 163mm2 (the A5X chip). There have been die size increases for other chips as well (for instance, NVIDIA’s Tegra), but given Apple’s dominance in smart phones and tablets, they believe Apple’s die size increases have disproportionately driven this perception.

Downgrading ASML (covered by Kai Korschelt), KLAC to Sell

Slowing 32/28nm foundry capacity additions and an only modest 22/20nm ramp in 2H13 could drive material foundry bookings decline for ASML over the next 12mths, with 2013 EPS potentially declining YoY, 27% below consensus. Deutsche lowers their price target from E40 to E35. KLAC’s 2012 foundry orders imply the foundry segment is on pace to ~150k wspm incremental process control capacity, well above the 90-100k wspm capacity projections from semicap companies. Coupled with the fact that 28nm yields are finally increasing and process control intensity at 20nm node could potentially decline (less process variants at 20nm, no 20nm tool upgrade cycle such as SP3 for 28nm, stagnating die sizes), they see risk of multiple quarters of bookings slowdown in 2013. With shares trading near 52-week highs, at a premium valuation and considering high investor expectations, the firm recommends investors take profits as they see downside to ~$40-$45 levels. Lower price target from $56 to $44.

Notablecalls: This is a big call, DBAB pretty much busts 2 significant myths related to smartphone/tablet and Apple chip momentum and its’ effect on Semi capex.

While not mentioned in the above summary of the call, Deutsche is throwing some cold water on ASML’s UEV (extreme ultraviolet) revolution saying the Bull case is already pretty much priced in here, despite ’15-’16 roadmap. UEV is the reason why Intel and Samsung have made $1bln+ commitments to ASML in recent months helping to push the stock higher.

All in all, I think ASML and KLAC both will see meaningful amount of supply in the n-t. Both names will be down 3-4% today and more in the coming weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply