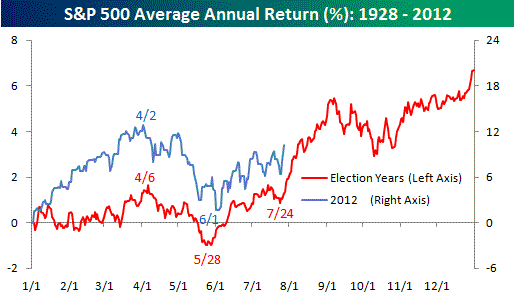

This chart from Bespoke made the rounds a few weeks ago, and it is interesting to note that it continues to work as a predictor of this year’s election rally. We have continued higher, and now may be in the final blow-off stage into early September.

It is mildly interesting to note that late August/early Sept tops happen in big turns years (1929, 1987 etc.); and also happen in relatively normal years. It is just that in an election year, the summer rally seems to last longer. The correction in Sept usually denotes uncertainty over the election. When it becomes clear who will win, the market rallies again. In 2008, the post-correction rally waited until the end; of course a lot was going on in Sept 2008.

The normal seasonal pattern is a rally commences in mid Oct to early November, and continues into late April or early May, with a mild correctiion in late Jan/early Feb. The market then has a June Swoon and Summer Rally, but essentially meanders sideways into Oct, until the seasonal rally takes off again.

The Election Year pattern shifts the swoon to later, usually after the Conventions, and starts the seasonal rally earlier, unless the election is a cliff-hanger (1980, 2000, 2008).

Of course, this is an average of many different years and circumstances, so don’t take it to the bank. Just note that almost every election is said to be critical, that the country is in crisis, that This Time It’s Different, and then it isn’t.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply