To add alpha, we believe investors need to continually seek pockets of strength amidst today’s mire of pessimism. One bright spot we’ve seen lies just east of Greece: Turkey.

Many investors believe banks are the only investment play in Turkey. The sole question for those investors is to hold or not to hold banks. Here’s what we think is a better strategy: Invest in undervalued, diverse, smaller companies that will benefit from a resilient consumer, low unemployment rate and sound government policies.

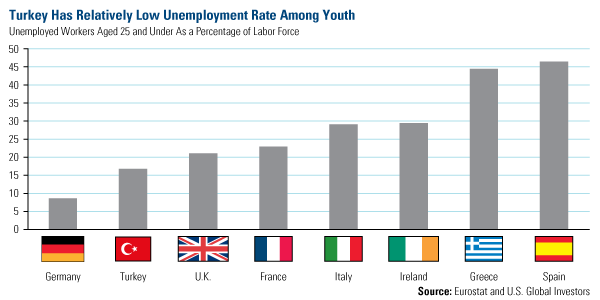

Among young people, Turkey’s unemployment rate is considerably lower than many countries in Europe, including Spain, Greece, Ireland and Italy. Germany is the only country with a lower unemployment rate than Turkey. This low rate translates to a vibrant, young workforce with rising wealth.

Even though Turkey has a strong domestic market, it often faces a current account deficit, meaning total imports are greater than the country’s total exports. (Turkey’s dependency on energy imports, for example, makes the country vulnerable to oil prices. As the price of oil increases, Turkey’s current account deficit grows, and vice versa.)

This external vulnerability is one of the reasons why Standard & Poor’s recently reaffirmed Turkey’s lira-denominated bond rating of BBB- and its foreign exchange credit rating of BB. In its report, S&P based its view on Turkey’s current account receipts, its modest income levels and risks related to the credit boom of last year. S&P says that Turkey’s GDP growth was “mostly driven by rapid domestic credit expansion, financed mainly by short-term external funding to banks.”

However, S&P explained that the current ratings are supported by its view of Turkey’s “generally effective policymaking and institutions, its moderate and declining public debt burden, and its monetary policy flexibility.”

At the CFA Conference in Chicago attended by our director of research, John Derrick, Sam Zell discussed his key theses on investing in emerging markets. Sam believes one should be invested for a few years before a country becomes investment grade because leaders tend to implement responsible policies in line with rating agencies’ requirements.

To improve its credit rating over the long-term—and to reduce its current account deficit—Turkey has been implementing policies that encourage an increase in the domestic production of goods and makes its exports more competitive to attract capital. For example, Turkish mining law is investment-friendly, as there is little bureaucratic control, an easy permitting process, and lower fees, and allows broader activities for companies involved in mining gold, copper and boron. These policies will likely encourage mining companies to dig up the natural resources under Turkey rather than head to another country.

Case Study: Tale of Two Turkish Stocks

Of those companies that can capitalize on Turkey’s consumer strengths—retailers, glass makers and manufacturers of automobiles, washing machines and refrigerators—we focus on growth-at-a-reasonable-price (GARP) companies. We believe these undervalued companies that have revenues growing faster than GDP, are profitable and are well-run with a focus on building shareholder value are the most attractive investments.

Turkish food manufacturer Ülker (ULKER) fits the bill, trading at 15 times 2012 estimated earnings. Ülker owns the household-name Godiva. The luxury chocolate brand has 275 company-owned and managed specialty boutiques in North America alone, and is sold in more than 80 countries around the world. After reporting that first-quarter profits had more than tripled, the stock rose to all-time highs, during a time other emerging markets stocks were declining.

Other global brands, though they exhibit growth traits, are expensive. Coca-Cola Icecek (CCI) is one of the fastest-growing bottlers among Coca-Cola’s universe, with about 70 percent of its revenue coming from domestic sales, according to Morgan Stanley Research. However, the stock seems pricey, with a 2012 price-to-earnings ratio of 23 times.

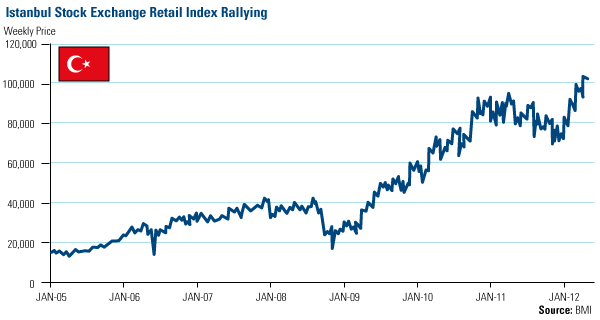

The market has begun to recognize Turkey’s strengths this year, especially in the retail sector. As you can see below, Turkish retail equities have rallied significantly since the start of 2012. These stocks have already surged well beyond the 2008 peak and pushed through the 2011 high last month.

Turkey’s Accessible Market

According to Russell Investments, Turkey has the largest and most liquid small-cap market among emerging market countries. Whereas many small caps in emerging countries take a few days to trade, in Turkey, it only takes one day, on average, to build a position. This reduces the liquidity risk inherent in international small companies, and for an active manager, provides flexibility for selling stocks as the market rises and taking advantage of dips on the down days.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply