With French and Greek voters rejecting austerity, politicians are once again taking the government spending debate seriously. This column argues that the voters are right – it is a bad idea to tighten fiscal policy when growth is so feeble. But the column adds that, wherever one looks, the road away from austerity looks desperately blocked.

Thanks to French and Greek voters, austerity is finally being debated seriously. Until now, the debate was circumscribed to economists, with the usual Keynesian and anti-Keynesian chapels trading theoretical and empirical arguments over the size and the sign of the multipliers.1 As usual, any prejudice can be buttressed with some research.

It has now emerged that growth in Greece and elsewhere has been “disappointing” and that debt-to-GDP ratios do not decline much when growth is negative and deficits are “surprisingly resistant”. The problem is that even enthusiastic pro-growth economists will find it hard to come up with policy suggestions that can turn the situation around reasonably soon. Structural reforms are what are badly needed, but their effects are too slow for prompt relief.

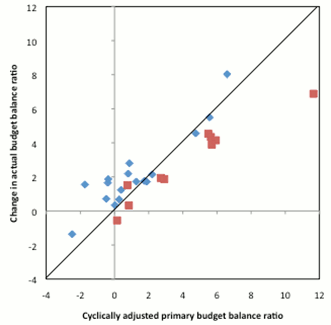

Figure 1 shows the relationship between budget stabilisation efforts, measured on the horizontal axis as the change in the cyclically adjusted primary balance ratio to GDP, and the change in the actual budget balance ratio. The 45 degree line is the effort-equals-effect threshold – i.e. the austerity efforts (horizontal axis) are matched by actual improvement in the primary deficit to GDP ratio (vertical axis).

- The squares correspond to those countries where real GDP overall growth over the period was less 2.5%; in these countries, with one exception (Hungary, which stabilised earlier) the outcome is worse than the effort.

- The diamonds represents countries that grew faster; in these, the outcome was at least as good as the effort.

Plainly it is a bad idea to tighten fiscal policy where growth is feeble (or negative).

Figure 1. Budget balance effects of budget consolidation efforts

Notes: The sample includes all EU member countries. The period covered in 2009-2011.

Source: AMECO on line, European Commission.

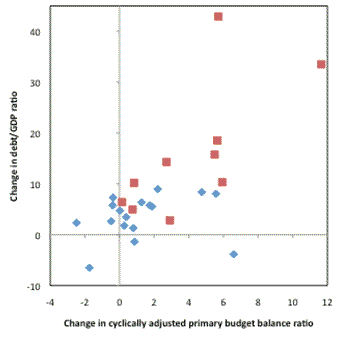

The results from budget consolidation efforts are even more disappointing when looking at the evolution of the gross public debt. For the same countries and over the same period, Figure 2 displays on the vertical axis the change in the debt-to-GDP ratio while the horizontal axis measures the fiscal consolidation effort exactly as in Figure 1.

The message from this chart is damning: with three exceptions (Estonia, Hungary, and Sweden), debt-to-GDP ratios rose everywhere in the EU, even in countries that were reducing their cyclically-adjusted primary deficits. For those countries where GDP growth was less than 2.5% over the two years, the debt ratios often increased much more (even though in one case, Ireland, this was a one-off bank bailout). For these countries, it even seems that the debt increases faster where the effort is stronger.

Figure 2. Debt effects of budget consolidation efforts

Source: AMECO on line, European Commission.

Clear evidence in the eyes of voters

The evidence is informal but it is quite consistent with formal studies that report non-trivial positive multipliers. Importantly, it is what voters see. They cannot be blamed for concluding that the economic, social, and personal pain that they suffer – and that many of our colleagues in economics seem to ignore or belittle – is not delivering or is even backfiring. Even though the cases of Hungary and Estonia, which went through consolidation and wrenching recessions earlier, show that there is light at the end of the tunnel, the case for carrying out fiscal consolidation “no matter what” is very weak at best.

What could different policies look like?

The answer, unfortunately, is bound to be disappointing. Monetary policy is quasi-impotent as far countercyclical action is concerned.

- The interest rate can be lowered, but it is so close to zero that any effect would be largely symbolic.

- Quantitative easing has yet to prove its effectiveness.

Preliminary evidence from the long-term refinancing operations (LTROs), which have been instrumental in suspending the debt crisis as argued in Wyplosz (2012) , is that banks stack up cash but do not lend, in part because they are busy deleveraging, in part because demand for credit is in hibernation.

- The only contribution that monetary policy could make would be a sizeable exchange-rate depreciation – but against which currency?

The dollar is weak because the markets expect some action to stop the US federal debt from spiralling away. East Asia, the new economic powerhouse, follows China in tracking the dollar. Latin America, the second economic powerhouse, is panicking as their exchange rates rise. Still, a weak euro is the best that can happen.

Turning to fiscal expansions, the situation is depressing. Several countries have lost market access and a few more are on the verge of losing it. While the financial markets clamour that they want to see growth and no austerity, they will not provide ample financing to countries like Italy, Spain, and France. Ideally, countries with an ability to borrow would play the locomotive role, but a locomotive must be powerful enough to pull the wagons up the hill. That leaves us with Germany, but Germany is now at full employment. Expanding its already sizeable debt to add heat to an already hot economy, which would bring up inflation – a highly unattractive option.

European Investment Bank saviour?

This is why people look at clever ideas. One of them is to allow the European Investment Bank (EIB) to borrow and finance spending. The attraction is that EIB borrowing is guaranteed by the member state but does not add to official public debts. But numbers matter. The annual spending budget of EIB is about 0.5% of GDP. Even a doubling would represent very little firing power, assuming that enough projects can be prepared for rapid disbursement, which is unlikely.

Another creative idea is to discover that the Commission has unspent money, again of a similar amount. How quickly this money may be made available remains to be seen – the Commission is, after all, a fairly heavy bureaucracy with rigid procedures. Furthermore, “European money” from the EIB and the European Commission is unlikely to be entirely channelled to the Eurozone countries that need it most for macroeconomic reasons. More importantly, perhaps, is the reminder by Alesina and Giavazzi (2012) that the composition of fiscal policy actions matters. In countries with arguably excessive public spending, expansionary fiscal policies stand to be more logical and more effective if they take the form of tax cuts. That is not in the hands of the EIB and the Commission.

Another creative idea is to issue Eurobonds to finance emergency spending. By being collectively underwritten by all member countries, these bonds could be subscribed by the financial markets at low interest rates. Ultimately, however, they would be indirect debts of individual member countries, many of which are already over-indebted. This means that the more reputable countries would assume the risk that the most indebted ones are eventually unable to pay back.

A way around the problem would be to make these new bonds senior to existing ones, either formally as suggested by Delpla and von Weiszacker (2010), or informally by being short-run as proposed by Hellwig and Philippon (2011). In principle, even hard-pressed governments could borrow large amounts in this way. The problem is that the existing bonds would become junior, which could precipitate a market run and eventually lead to defaults. A safer way to finance hard-pressed governments is by the ECB but this is against the Treaty and anathema to Germany and many others, for good reasons.

Finally, the last possibility is default by governments that need to shift their policy stance but cannot do so because of high indebtedness. By eliminating a significant portion of their public debts, those governments would instantly cut a big spending item, debt service, and recover the breathing room that they need. The default would have to be deep enough to allow them to recapitalise their banks, which hold domestic public bonds, and still end up with a small enough debt. The problem is that defaults cut borrowers off from market access for a while. Defaulters would therefore need to secure support from the IMF and, quite possibly, from other Eurozone member countries, all of whom are unlikely to give their blessings, especially since many governments are concerned about losses suffered by their own banks. They may prefer squeezing defaulting countries out of the Eurozone, a process that could prove to be highly contagious and quite possibly lead to the premature death of the euro itself.

Monetary policy out of order, no policy space, the EIB and Commission too small, Eurobonds impractical, deep defaults unacceptable and possibly resulting into a Eurozone breakup; wherever one looks, the road away from austerity looks desperately blocked.

What is left? Small steps that add up to not enough of a stimulus

The madness of holding governments to infeasible debt reductions within a couple of years or so must be replaced by the realisation that this objective will take decades, not years, to be reached.

Some countries will have to default, partly at least, entirely for Greece. Inevitably, the costs will be borne by everyone – bondholders, banks and their governments, and the Eurosystem.

EIB and Commission money will help a little if they are promptly disbursed. Germany must also conclude that playing the locomotive is in its deep interest and that a little bit of inflation is much more preferable than letting the euro disappear. After all, average German inflation over the roughly 50 years before the euro (1950-98) was 2.7%.

Sticking to austerity is bound to lead to more Greek-style elections. This is after all the lesson from German history – voters who suffered and despaired and felt mistreated by foreign powers ended up voting for Hitler.

References

•Alesina, A and F Giavazzi (2012), “The austerity question: ‘How’ is as important as ‘how much’”, VoxEU.org, 3 April.

•Delpla J and J von Weizsacker (2010), “The Blue Bond Proposal”, Bruegel Policy Brief 2010/03, May.

•Hellwig, C and T Philippon (2011), “Eurobills, not Eurobonds”, VoxEU.org, 2 December.

•Perotti R (2012), “The “Austerity Myth”: Gain Without Pain?”, in F Giavazzi and A Alesina (eds.), Fiscal Policy After the Crisis, NBER.

•Wyplosz, Charles (2012), “The ECB’s trillion euro bet“, VoxEU.org,

__________

1 For a recent balanced evaluation, see Perotti (2012).

![]()

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply