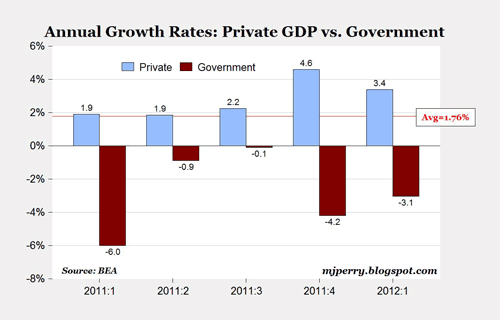

The BEA reported today that the overall economy (real GDP) grew by 2.2% at an annual rate in the first quarter of 2012. However, the private components of GDP (personal consumption expenditures, gross private domestic investment, and net exports) grew by 3.4% from January-March, following a 4.6% increase in Q4 2011 (see chart above). In contrast, there was a 3.1% decline in total government spending in Q1, which created a drag on overall economic growth and brought real GDP growth down to 2.2%. The decrease in government spending was driven by a 12.1% decline in first quarter spending on national defense and ongoing cuts in state and local government spending (-2.2% in Q1).

The average growth rate in private real quarterly GDP since 2000 has been 1.76%, so the private sector of the U.S. economy expanded in the first quarter of 2012 at twice the average rate over the last 12 years (see chart). And going back to 1947, private real GDP has grown at an average rate of 3.27% per quarter, so the expansion of private GDP in the first quarter is slightly above the long-term historical average.

Bottom Line: Perhaps today’s GDP report is actually better than what is being reported, as the private sector of the U.S. economy grew at a rate slightly above the historical average, and twice the average rate since 2000.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply