The overall market, as represented by the S&P 500, has had a tremendous run from the October lows. Even through all of the never-ending struggles with the European crisis, unemployment still high, and a slowing world economy, the S&P 500 has managed to gain over 27%, approximately, over the last six months. That is a tremendous amount over a short period of time and the question I get asked all of the time is: what happens now? I’ll give you two criteria that are showing some warning signs regarding the market sentiment of the S&P 500, both of which are pointing to a market correction.

Recent reports from TrimTabs Investment Research indicate that company executives (insiders) are selling at a brisk pace, almost $13.00 of shares sold for every $1.00 bought. The last time insider selling peaked was back in May of 2011, which was just prior to the summer market correction in the S&P 500. Market sentiment indicators for the S&P 500 don’t always predict a market correction, but, taken together with other indicators, it can raise a big warning flag for investors. While many executives do have set times for selling shares, this much lopsided selling can certainly be indicative of market sentiment overall for the S&P 500. Insiders are telling us through their actions that they are uncertain if current levels in the S&P 500 can be maintained and want to take some profits before a market correction.

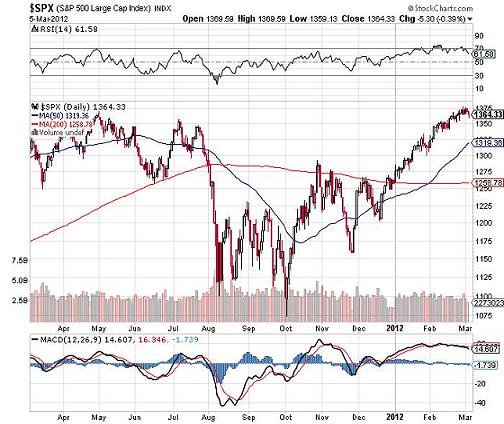

This is a daily one-year chart of the S&P 500. You will notice the May peak, which was also a period when insiders were heavy sellers. Of course, no one can predict when a market correction will occur, as many things go into such an event. Last year there was political turmoil as well as environmental disasters. But insiders certainly feel that the market, viewed by the S&P 500, is fully valued; otherwise, they would be buying some shares.

The second indicator that looks at market sentiment in a different manner is the Dow Jones Transportation Index. The reason I highlight this index is for you to compare the recent moves of this index to the S&P 500. You will notice a significant divergence between the two markets in February. The transportation index is a market sentiment indicator that shows the underlying health of the economy. As the economy improves, more goods are shipped to and from stores and supply warehouses. More goods are used, more houses built, more things are built and sold. Conversely, in a bad economy, fewer things are built, shipped and sold. The recent market correction in transports is hinting that there might be more weakness than the S&P 500 is showing us. While this doesn’t mean that a market correction will occur in the S&P 500, as it could be possible for the transportation index to turn up and catch the S&P 500, it certainly should be a warning flag for investors who are heavily long the S&P 500 that a market correction is becoming more possible.

One indicator alone can’t predict a market correction in the S&P 500. An investor needs to combine several market sentiment indicators to get a better picture of what the underlying trends are for the S&P 500. These little warnings flags should, at the very least, raise the possibility of a market correction.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply