The market is beginning to reprice Apple (AAPL) to a multiple that it deserves, in our opinion, and got an added boost yesterday from James Altucher’s call that Apple is a “no brainer…to hit a trillion dollar market cap within the next year.” That’s a $1,000 stock, folks!

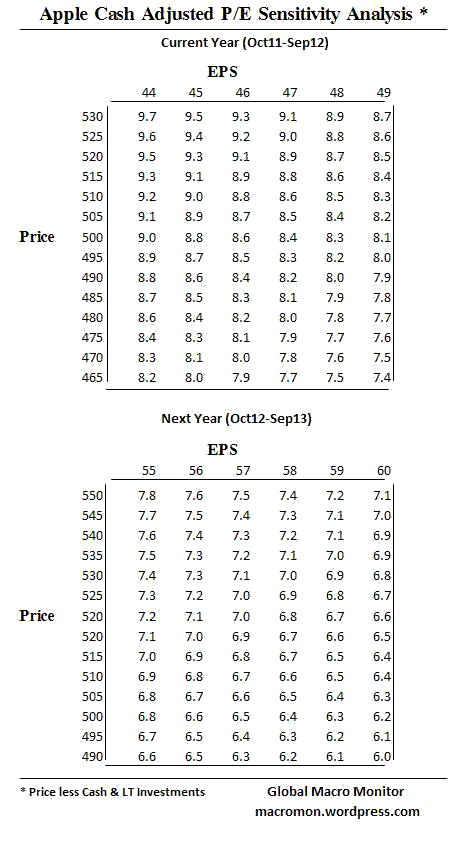

Altucher’s incredulous call caused us to revise our Apple sensitivity analysis. We couldn’t believe the numbers and we had to check and recheck the data. We invite you to do the same, which might increase your conviction in the stock.

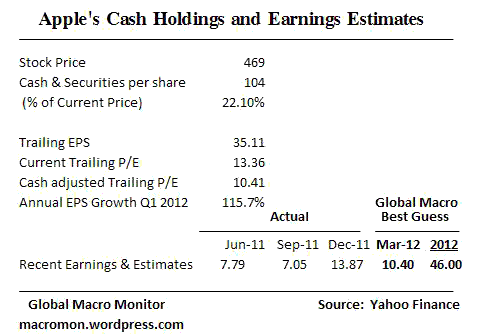

Apple currently trades at $469, which consists of almost $104 in cash per share. The company has no debt and has a trailing EPS of $35.11, or a 13.36 multiple and 10.41 cash adjusted multiple. Extremely cheap given the latest quarter EPS growth exceeded 115% y/y.

Even assuming a conservative growth rate of half the 115% for the rest of the fiscal year, Apple could earn $46 per share this year. This equates to a cash adjusted P/E ratio of less than 8x. Stunning!

The stock has run quite a bit and made need to consolidate some gains, but our sense the market is finally starting to believe and is now in full repricing mode, which can take AAPL much higher. This is an epic company as the world moves into the Wireless Age.

Long, always with a stop.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

If there is one thing better than owning a good stock to offset your loses, it’s having no losses.

Apple is the only stock I have owned since 1992.