Equity futures are down this morning. Bond and dollar futures are both higher. Higher during a week that they are issuing $235 billion??? Now here’s my question… how do we finance $235 billion of bond auctions in one week – WHERE DOES THE MONEY COME FROM? Well, if we look at the bid results, we find that the Primary Dealers (PDs) are doing more and more buying each week. And when we look at the TIC data, we find that international buyers are doing more selling than buying. So, if the money to buy such massive issuances is coming from the PDs, then they have to be using their own cash or equivalents to buy them – correct?

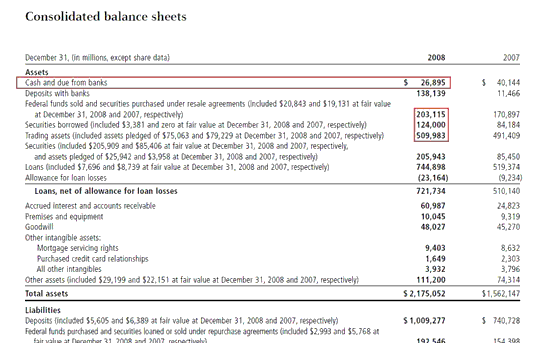

So, let’s go and look at the balance sheets of the biggest Primary Dealers and see how much cash they possess… Let’s start with JPMorgan (NYSE:JPM). Here’s their balance sheet from their 2008 Annual Report, page 131 (click to enlarge):

It shows roughly $27 billion in immediate cash.

Now let’s look at the balance sheet of Goldman Sachs (NYSE:GS) (click to enlarge):

Here we find $35.4 billion of cash and cash equivalents. Hmmm… Okay, let’s say that the 5 biggest each have that amount – 5 times 35.4 = $177 billion. Of course they can’t place 100% of their cash and equivalents in long term bonds, so I would assume that only a fraction of that money would actually be available to buy at auctions. Of course there are their “trading assets” which we have no idea how they are used. But my premise is that week after week of $100 billion or now $200+ billion auctions cannot be supported by the money that the Primary Dealers possess.

So again, WHERE’S THE MONEY COMING FROM? Since I can’t see where the money is coming from, I’m going to throw a wild guess out there and say that the government and PDs are simply printing it as they go! How much? WAY, WAY more than the announced use of Bernanke’s $300 billion. Sound like a conspiracy theory? It is, and I invite the Fed, the Treasury, and the Primary Dealers to open their books and prove me wrong. I want to see a paper trail leading to the purchase of those bonds and treasuries!

This is a vitally important question to have answered for the future of our country – CRITICAL.

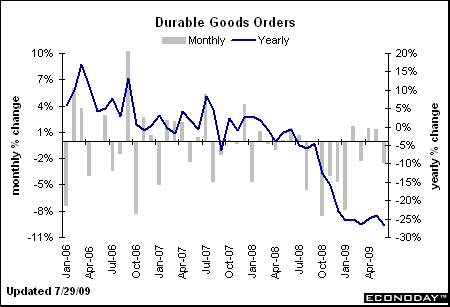

Okay, to the daily economic data releases… the MBA Mortgage Application index came in unchanged. And then I read positive headlines on CNN regarding Durable Goods Orders – POSITIVE.

Here’s the reality. Durable Goods Orders have fallen 26.8% (HELLO 26.8%!!!!!) on a year over year basis. You can remove all the components you want to try and make that better, good luck!

Highlights

New factory orders for durables in June dropped sharply, largely on a plunge in civilian aircraft orders. Durable goods orders fell back 2.5 percent in June, following a revised boost of 1.3 percent the month before. The decline in June was worse than the consensus forecast for a 0.5 percent dip. But excluding the transportation component, new durables orders advanced 1.1 percent, following a 0.8 percent gain in May.

The drop in new orders was widespread but was led by transportation, down 12.8 percent. Within transportation, nondefense aircraft fell 38.5 percent, defense aircraft jumped 30.1 percent, and motor vehicles slipped 1.0 percent. The other notable decline for a major category was communications equipment which fell 10.8 percent. Weakness was also seen in fabricated metals, computers & electronics, and “other.”

Showing gains were primary metals, up 8.9 percent; machinery, up 4.4 percent; and electrical equipment, up 0.9 percent.

Due to the fall in aircraft orders, nondefense capital goods orders declined 3.4 percent after a 9.1 percent surge in May. Excluding aircraft, the trend is still up as this component rose 1.4 percent in June, following a 4.3 percent boost the month before.

A positive for future production was another drop in durables inventories-which declined 0.9 percent in June after a 1.1 percent drop the prior month. Low inventories mean that at some point, manufacturers will have to boost production.

Year-on-year, overall new orders for durable goods slipped to down 26.8 percent in June from down 23.9 percent the previous month. Excluding transportation, new durables orders edged down to minus 24.1 percent from down 23.0 percent in May.

Today’s report is primarily a negative for Boeing-not new news. Outside of transportation, orders were mixed but still continuing the gains from May. The new orders for durable goods series is notoriously volatile but the latest numbers still suggest that the recession in manufacturing may be ending soon-especially with inventories getting low.

May be ending soon with a 26.8% cliff dive? OMG, if that’s not psychosis on a more localized level, I don’t know what is. Literally nuts.

From a technical perspective, it’s looking to me like we may have just begun wave 3 down of 2 down of c up of B up. The pullbacks have been shallow and the advances strong when they happen which is what you would expect when in a strong bear market rally.

I think there’s funny money being created through the Fed’s surrogates and that’s the fuel behind it all. If the amount of money they were using for such purposes becomes public, it would blow the lid off the entire world’s financial system. Personally, I think anyone is just plain nuts to lend the United States a nickel – you will simply be given a worthless slug in return.

AUDIT THE FED, but make sure it’s INDEPENDENT AND AUDIT THE TREASURY AND PRIMARY DEALERS WHILE YOU’RE AT IT!!

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply