Maybe I’m a little jumpy, having just created a series of videos about business planning with a risk of recession.

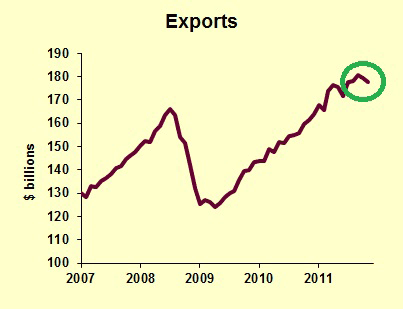

Today’s foreign trade data worry me. If the United States economy is going to turn down, then foreign trade is the most likely source of the slump. Consumers are fairly stable now, spending in pace with their income gains. Housing and non-residential construction are weak, but don’t have much room to worsen. Government spending is not going to suddenly crash. The two major risk areas are exports and business capital spending.

The latest decline in exports may just be a blip. It’s not unusual to have a sawtooth pattern, with the little dips being meaningless in the long run. That could be the case here. However, we know that Europe is slowing down and quite possibly in recession now. China’s economy is growing less rapidly due to its inflation-fighting efforts. (For more details, see my China economic forecast article.)

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply