As China’s appetite for commodities slowed this year, much of the world’s copper demand went with it. Despite this softening in demand, Macquarie Research thinks the red metal could see a rebound in 2012 because copper mines are struggling to supply the marketplace with adequate reserves.

Macquarie says, “Global copper mine output has continually disappointed forecasts and, more importantly, market needs over a number of years now, despite the strong financial incentive not only from high copper prices but also high by-product prices.”

Chile, the world’s largest copper-producing country, has had a series of struggles that has curtailed production gains. Macquarie says the country’s output has fallen by 730,000 tons over the last decade and a lack of new mining investment has been insufficient to offset fledgling production. Furthermore, a three-month strike at the world’s second-largest copper mine, Freeport MacMoRan’s Grasberg mine in Indonesia, has also limited copper production.

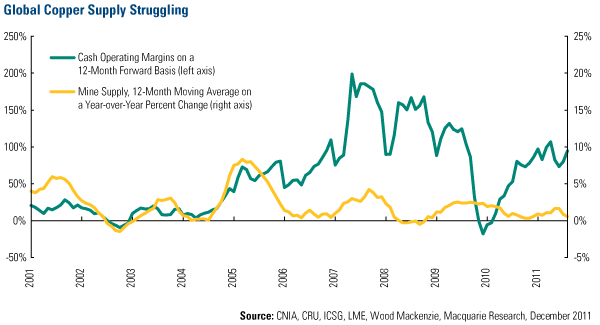

The first chart illustrates how correlated copper mine production has been with the operational cash flows of mining companies over the past 10 years. Escalating costs to develop and operate new mines are one of the main constraints to copper supply. HSBC estimates investing in new copper mines is 50 percent more expensive today than it was in 1985 due to higher energy costs, better wages and equipment shortages.

To reach untapped deposits, companies must finance new technologies and equipment to develop deeper mines with often lower ore deposits in sometimes politically unstable parts of the world, research firm Credit Agricole says. This is why copper supply has remained relatively flat despite companies’ willingness to spend near record amounts of money to find additional ore deposits.

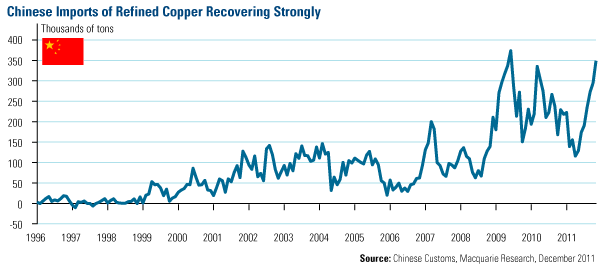

Despite bullish sentiment heading into 2011, copper’s price has largely underperformed this year as China scaled back on large purchases. However, recent trade data suggests the world’s largest consumer of natural resources is restocking its depleted inventories.

Chinese copper imports totaled nearly 452,000 tons in November, the highest monthly total in nearly 20 months, according to data from Macquarie. By 2012, Bank of America-Merrill Lynch analysts suggest China will continue its copper shopping spree. BofA-ML is predicting a 6 percent year-over-year increase in Chinese copper imports next year.

Sluggish copper mine production and increasing demand from China should help boost copper’s price moving forward. BofA-ML says, “Supply problems will remain a constituent part of the copper market” before additional copper supplies become available in 2013.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply