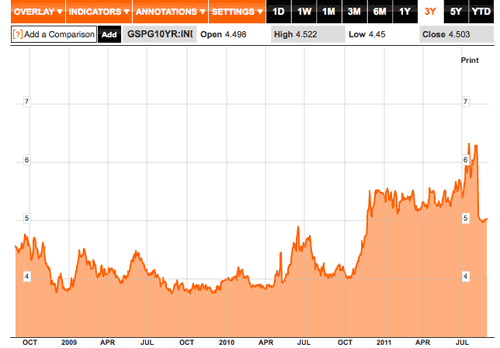

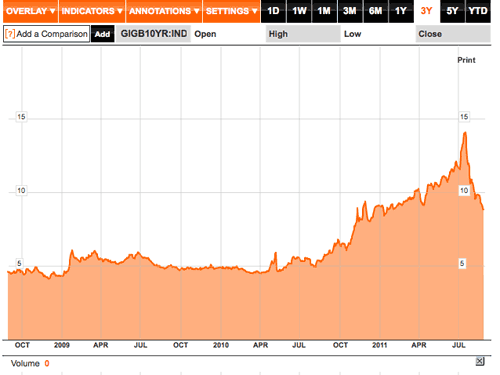

A move in the opposite direction would have made it to the headlines of all financial newspapers but, just in case you missed it, here are the yields on 10-year government bonds for Ireland and Spain. They are still high relative to where they were before the crisis but they have been falling very fast over the last weeks. Some of this fall has to do with lower interest rates everywhere else (so the spread with the German yields has not fallen as much as what you see in these figures), but from the perspective of sustainability of government debt what matters is the interest rate you pay on your bonds and not the differential with a safe asset.

Spain 10-Year Government Bonds

Ireland 10-Year Government Bonds

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply