Here is an interesting article from the Federal Reserve Bank of San Francisco on the potential effects that demographic changes could have on the stock market in the US over the coming decades. As baby boomers retire and sell their assets, including stocks, their prices are likely to go down. The issue is not new and has been debated before but what is novel in their research is the correlation between a standard measure of the demographic composition of the population and the price-earnings ratio in the stock market.

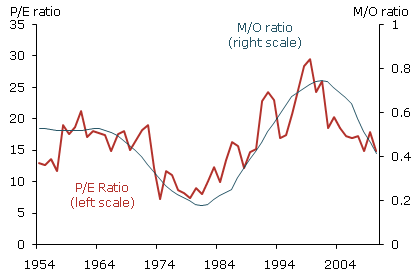

The image below shows the price earnings ration (P/E) and the ratio of the middle-age cohort (age 40-49) to the ok-age cohort (age 60-69). This is labelled as M/O in the chart. There is a clear correlation between the two series.

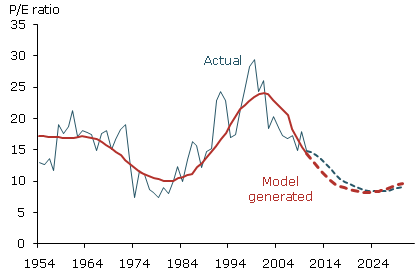

And if we look forward, this is what their paper predicts:

Their model generates a return of the P/E ratio to the low levels of the late 70’s early 80’s.

There remains, of course, uncertainty about this prediction given that it relies on many factors (such as demand coming from other countries, changes in retirement age), but the correlation of the first figure provides a strong enough argument so that the issue cannot be ignored.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply