Prior to the U.S. Bureau of Economic Analysis’s (BEA) benchmark gross domestic product (GDP) revisions announced three Friday’s ago, we were devoting a fair amount of space—here, in particular—to picking apart some of the patterns in the data over the course of the recovery. Ahh, the best-laid plans. As noted in a speech yestertday from Atlanta Fed President Dennis Lockhart:

“It’s been an eventful two weeks, to say the least. Let’s now look ahead. The $64,000 question is what’s the outlook from here?…

“Whether we’re seeing a temporary soft patch in an otherwise gradually improving growth picture or a deeper and more persistent slowdown, most of the arriving economic data lately have caused forecasters to write down their projections. Also, and importantly, the Bureau of Economic Analysis in the Department of Commerce has revised earlier economic growth numbers. These revisions paint a different picture of the depth of the recession and the relative strength of the recovery.”

Beyond keeping the record straight, revisiting the charts from our previous posts in light of the new GDP data is a key input into answering President Lockhart’s $64,000 question. Here, then, is that story, at least in part.

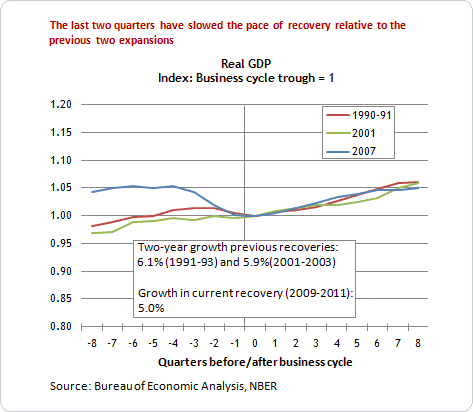

1. Even ignoring the depth of the recession, the first two years of this recovery have been slow relative to the early phases of the past two recoveries.

I wasn’t so sure this was the case to be made prior to the new statistics from the BEA, but the revisions made clear that, while still broadly similar to the slower growth pattern of the prior two recoveries, the GDP performance has been pretty easily the slowest of all.

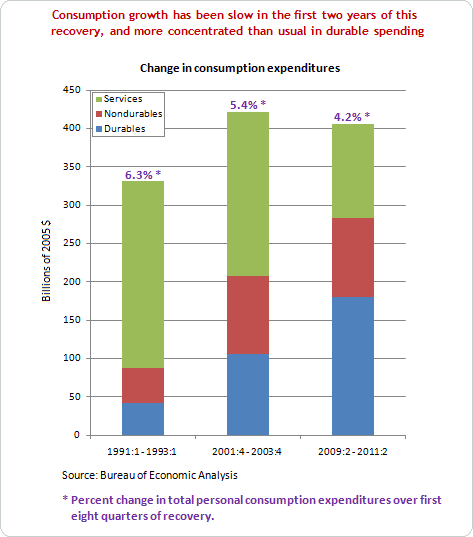

2. Consumption growth has been especially weak in this recovery, and the pattern of consumer spending has been more concentrated in consumer durables than has been the case in prior business cycles.

The consumer spending piece of this puzzle has President Lockhart’s attention:

“I’m most concerned about the effect of the wild stock market on consumer spending. Volatility alone could have a negative impact on consumer psychology at a time of already weakening spending. Last Friday, it was reported that the University of Michigan’s Survey of Consumer Sentiment fell sharply in early August to its lowest level in more than 30 years. Furthermore, if the loss of stock market value persists, the effect from the loss of investment value could combine with the loss of value in home prices to discourage consumers more and longer.”

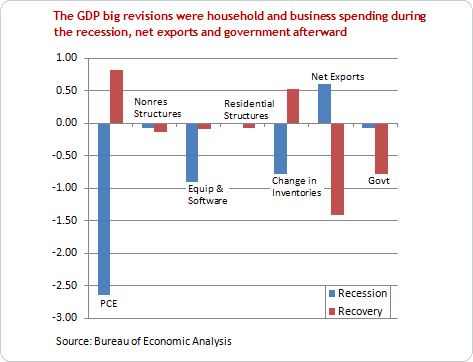

On the bright side, the GDP revisions did not of themselves alter the household spending picture. Though the benchmark revisions contained significant changes in consumer spending, those changes were concentrated during the recession in 2008 and 2009. Personal consumption expenditures were actually revised upward from 2009 on, with the big negative changes coming in net exports and government spending:

Are there other rays of hope? I might add this:

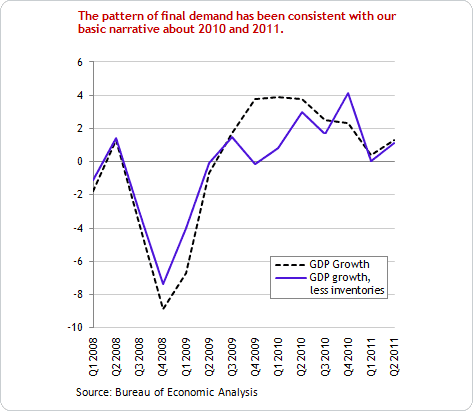

3. The revisions show that the momentum that seemed to fade through 2010 was more apparent in total GDP than in final demand. In other words, the basic storyline—a good start to 2010 with a soft patch in the middle and a stronger finish—still emerges if you look through changes in inventories.

That observation does not, of course, help salve the pain of the very anemic first half of this year. Nonetheless (from Lockhart, again):

“At the Atlanta Fed, we have revised down our near and intermediate gross domestic product (GDP) growth forecast, but we are holding to the view that the economy will continue to grow at a very modest pace. In other words, we do not expect the onset of outright contraction—a recession—but I have to say the risk of recession is higher than we perceived a month or two ago…

“The rapid-fire developments of the last several days, along with some troubling data releases, have shaken confidence. People are worried. Investors, Main Street businessmen and women, and consumers are wondering which way things will tip. The public—and for that matter, policymakers—are operating in a fog of uncertainty that is thicker than normal.”

That fog of uncertainty was made thicker by the GDP revisions, and thicker yet by the volatility that followed. But I would still pass along this advice from President Lockhart:

“At this juncture, we should not jump to conclusions. A clearer picture of economic reality will be revealed in time as immediate uncertainties dissipate. It’s premature, in my view, to declare these important questions relating to our economic future settled.”

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply