What to make of the move by S&P? I will tell you that I was surprised that it happened this weekend. I expected that S&P would have given the US to November to sort things out. From the news reports it appears that the White House and Treasury were equally unprepared for this to happen now. Some thoughts:

Market Reaction

It is quite likely that we will see some interesting market action come Sunday night as this news is digested. But I will stick my neck out and say that once the dust settles a bit the ratings drop is not going to have a significant effect. (for now)

It looks as if the US is going to have a split rating. (AAA {equivalent} by Fitch/Moody’s and AA+ by S&P) If this were a high-grade corporate credit the split rating status would make no difference in how the underlying bonds trade. I doubt that the S&P action will have a different (lasting) consequence.

S&P Timing

What was S&P thinking when they pushed this on August 5th? Have they no sense of timing at all? We have just gone through the most gut wrenching market week in three years. This action could be very upsetting to global capital market conditions. While I think that is not going to be the case there certainly is risk for things to become unglued for a bit.

While I don’t fault S&P for their action (they said they would do this on April 18th) I think they made a big mistake with bringing public last Friday. For this, I would give S&P a single D rating.

The Rationale

We lowered our long-term rating on the U.S. because we believe that the prolonged controversy over raising the statutory debt ceiling and the related fiscal policy debate indicate that further near-term progress containing the growth in public spending is less likely than we previously assumed and will remain a contentious and fitful process.

My read of this is that they are blaming the politicians. As well they should. I hope that this is the message that comes to the public. It’s the idiots in D.C. that did this to us. They could not come to a compromise when the Nation required that they do so. The “Deciders” let us down. The economy will pay a price for what has happened. I truly hope that some of those Deciders pay a big price too. I think they will.

The Political Fallout

All of the big hitters in Washington have egg on their face today. But the one with the most egg is Tim Geithner. He said that a downgrade would not happen. It has. I think Geithner will have to go as a result. I think his “resignation” announcement will come before September 1st.

The Fed’s Response

Last night the Fed gave the S&P action a “We don’t care” response. There will be no change in how the Fed adjusts collateral requirements. There will be no change in their calculations of risked based capital for financial institutions.

It’s predictable that the Fed would take this position. What else could they do but ignore the downgrade? A key question is how central banks outside the US look at US collateral. Will any of them change the haircuts on US paper? I doubt it. But if I’m wrong and we see the Bank of Canada, England or ECB do anything regarding collateral ratios there will be hell to pay. That’s the best reason why they won’t do anything.

China/Russia Reaction

The Chinese downgraded the US some time ago. They don’t think so much of our paper. Russia is a big holder too. I would expect that we see evidence in the coming months that these two are going to be lowering their holdings. I don’t expect to see some big headline that says, “China to sell”. That’s not going to happen. The critical issue is, “Will they buy more?” I doubt they will.

The Russians must be jumping for joy at this. As this plays out we will see very clearly who are friends and who are not. On this issue, these two are not our friends. Yet they hold a total of $1.5 trillion of our paper.

On the Knock on Affect

S&P lists the entities related to the US that will have their ratings dropped. Fannie, Freddie and Ginnie Mae have been cut. Together that is about $6 Trillion worth of paper.

S&P has said that the ratings change for the US does not impact corporate ratings. But the states and cities are another matter. To me it’s just nutty to think that the city of Syracuse is a AAA and the federal government is worth less than that. No doubt but that Muni downgrades will be forthcoming. This should have happened years ago.

Impact on Fed Policy

If I was a rating Agency I would look at the policies of the government as a whole when setting a rating. Clearly the federal government is running up too much debt and S&P has said, “No mas”. The rating agencies want to see saner and more sustainable policies from D.C. They do not want to see kick the can down the road stuff.

There is no greater “kick the can” policies than those of the Federal Reserve. They have cut interest rates to zero. A desperation policy that is leading to big distortions in the basic funding markets today. They have bought Trillions of government paper. They have facilitated the expansion of US debt. They are part of the problem when it comes to long-term fiscal sustainability.

If the Fed announces another LASP (QE3) I now anticipate that the rating agencies will react negatively. More QE = More downgrade. I hope Bernanke and his cohorts get this message. Their hands are now tied at so many levels. They are pushing their own limits on inflation targets. They know that ZIRP is a failure. They understand that QE (LSAP) has only marginal benefits (at best) and they also understand (and have acknowledged) that additional QE efforts now come with more risk than reward.

It would have been helpful if the S&P had provided some thinking on this critical issue. S&P was willing to take on the entire legislative part of government. But they didn’t have the balls to take on the Fed. Interesting.

On Entitlements:

We have just a few months before the next explosion. S&P has put the US on a negative alert. Meaning further downgrades are going to happen if the US fiscal house is not put in better order.

Folks, that CANNOT HAPPEN without substantial cuts in both Medicare and Social Security.

So over the next few months when Harry Reid and Nancy Pelosi tell us that there will be no cuts to these mega programs, respond by immediately shorting the stock market. If Obama sticks in the mud and says, “We will not cut SS” the Dow will fall 500 points.

This will be a gut wrenching process. The fate of the nation now rests on it however. Either these programs get contained in a meaningful way or everything we have come to know and love about this country will go into a two-decade collapse.

It was leaked

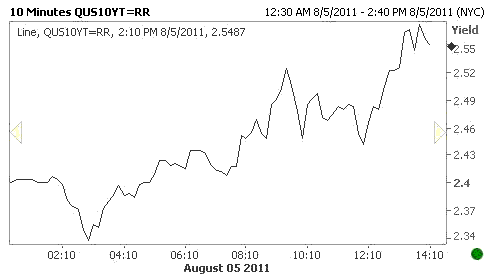

This article/chart from FTAlphahville makes the point that US long term rates had one of the biggest run ups in years yesterday. How did that happen? Easy. The info that S&P would make a move after the close was leaked. There are insiders all over Wall Street that got the “heads up”. What kind of system is this?

On Vigilantes

Paul Krugman (and many others) have been pounding the table and pointing to the bond market and saying, “See! Rates are low! We have to issue more debt, not less! We have to spend more, not less!

On several occasions in the past month Krugman has made this point. He says there are no vigilantes in the bond market. Well there are vigilantes. They are not the tough guys who trade bonds for a living. They are the white shirt boys at S&P.

Face it Krugmans of the world. Keynesian economics has hit its limit. You can’t spend your way out of this problem. That door is now closed.

If there is a silver lining to the S&P action it is that mainstream economists on both coasts of the US (but not Chicago) have also been downgraded. The notion that Debt = Growth is now a dead concept. I couldn’t be happier.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

There is said to have been significant internal debate on the downgrade at S&P; imagine the trepidation at Fitch or Moody’s should they be ever minded to follow!

As first movers S&P might reasonably hope to avoid being the ones who triggered disaster. Wonder if they considered this.

Come to think of it is it credible that Fitch and Moody’s would ever dare follow suit? What would be the consequences of a 2/3 or 3/3 downgrade?