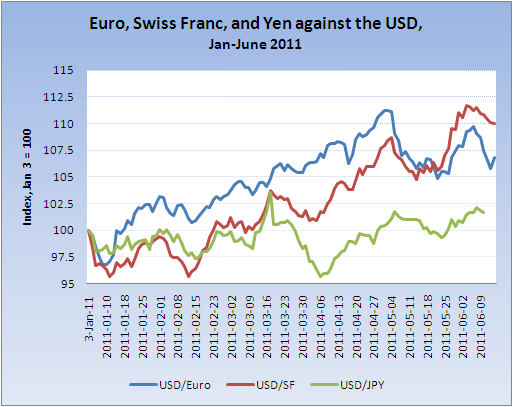

Exchange rates are on my mind this morning. Perhaps surprisingly, the euro has not been devastated recently by the high level of uncertainty regarding Greece. As evident in the chart below, the euro’s value against the dollar has fluctuated rather choppily over the past two months in response to developments in the Greek Debt Drama… but there has been no sustained loss in value. In fact, it’s not at all clear that a Greek default would devastate the euro; a high probability of default is already priced into exchange rates by now, so depending on how things happen (i.e. if it turns out not to be a complete disaster for the core European banks), it’s possible to imagine currency investors feeling relieved that the event is finally over, causing the euro to strengthen.

Meanwhile, the picture also illustrates that the Japanese yen recovered very quickly from a short drop in March in the wake of the earthquake disaster, and since then has trended slowly higher (unsurprisingly). Disasters for an economy — either real or financial — are not always disasters for the economy’s currency.

By the way, it turns out that the currency that wins the award for gaining the most strength so far this year is the Swiss Franc. I hope you haven’t put off buying that watch you’ve been wanting, because if you get paid in dollars, it has already gotten 10% more expensive this year for you…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply