Morgan Stanley’s Metals & Mining team is out with positive Sector call noting that last week’s slew of positive copper data points and outperformance in bellwether stock, FCX, could be harbingers of a shift in sentiment for the space.

They believe the recent ~15% correction provides more favorable risk-reward in steel (top picks AKS, X) and metals (FCX), in particular. Inflation and global growth remain key concerns among investors. Firm’s Chinese Economics team expects China CPI to peak in June, which could lead to improved sentiment on growth towards the end of summer.

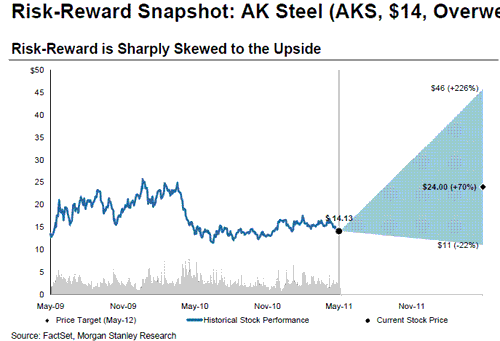

In particular, they are upgrading AK Steel (NYSE:AKS) to Overweight from Equal-Weight with a $24 price target (prev. NA) saying their Bull Case scenario points to $46 fair value (+266%).

The details:

Upgrading to Overweight: AK Steel is turning the corner, and earnings power is not priced in: While shares across the steel space have become cheap as a result of the recent correction, we see significant value upside in AKS shares, in particular (70% to our PT of $24). Our mid-cycle EBITDA estimate is 30% higher than what is discounted in the shares on our view that benefits from sustainable cost cuts, a lesser impact from iron ore costs, and improving margins in the company’s key electrical steel business have gone unnoticed.

Raising our valuation and estimates: We are raising our estimates by 30% in 2011 and 20-40% in 2012-13; we are now 15-40% above consensus in 2011-12 and 75% above in 2013. Our $24 price target is based on 10x 2012e EPS, and 5.0x our mid-cycle EBITDA estimate of $131/t.

Our higher estimates are a result of three factors: 1. Deep dive on mid-cycle earnings power: In the years leading into the downturn, AK Steel made significant sustainable cost cuts and operational improvements. We scrutinized the business and determined the company has improved sustainable EBITDA by $84/t since 2003.

2. New iron ore strategy: An iron ore margin squeeze was a major headwind for AKS shares in 2010, and investors remain concerned. We think the company’s tighter product markets enables it to pass iron ore costs through, and new contracts structures will make this automatic for 70% of sales.

3. Electrical steel market bottoming: Electrical steel appears to be recovering as ABB and Siemens reported strong growth in 1Q new orders, a good leading indicator of electrical steel volumes and pricing. This high margin business could improve EPS by $0.35 in 2012.

We see two catalysts in July: First, we expect steel prices to bottom around July; falling prices are currently an overhang. Second, we think 3Q guidance will surprise to the upside, which the company will release in late July.

Notablecalls: I think AKS has a fair chance of working on this call. Consider this:

– It’s Morgan Stanley making the call. One of the largest Sell side crews out there. It’s a sector call which adds some weight.

– The call makes sense, especially the part about iron ore cost pass-throughs (which I suspect was unknown to many). The electrical steel order trends at Siemens & ABB look interesting.

– It’s very difficult to resist the Bull case +266% price target.

– There’s a few catalysts out there. Always a plus. Morgan Stanley’s estimates are now way above consensus and they are calling for an upside surprise in July.

The market this morning looks awful but this may actually be a good thing as it enables you to get OK fills.

It’s one of those calls where you can expect a positive bias vs. the tape.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply