In the first quarter. Nonfarm business sector labor productivity increased at a 1.6% annual rate. That was much better than the consensus expectation of a 1.0% increase. The gain in productivity was due to a gain of 3.1% in output and a rise of 1.4% in hours worked (Seasonally adjusted annual rate).

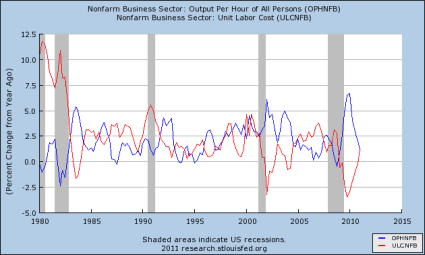

In addition, the fourth quarter productivity growth was revised up from 2.6% to 2.9%. On a year-over-year basis, output increased 3.2% while hours rose 1.9%, for an increase in productivity of 1.3%. Clearly productivity growth is slowing, but it is doing so from very strong levels.

Labor productivity, or output per hour, is calculated by dividing an index of real output by an index of hours worked of all persons, including employees, proprietors and unpaid family workers. Over the long term, productivity is probably the single most important economic indicator. It is what will govern per capita income. In the short term, however, when there is a high level of unemployment, rising productivity is a mixed blessing. Rising output is great, but if the same number of people can produce that higher output, you are not going to make a lot of progress on bringing down unemployment.

Unit labor costs in nonfarm businesses rose 1.0% in the first quarter, as a 2.6% increase in hourly compensation outpaced the 1.6% gain in productivity. The rise in unit labor costs was greater than the expected 0.8% increase. That, however, was offset by a downward revision to fourth quarter unit labor costs from -0.6% to -1.0%. Unit labor costs rose 1.2% year over year.

In the first quarter, the consumer price series increased at a 5.3% annual rate, resulting in a decline of 2.5% in real hourly compensation. The higher CPI was almost all due to higher food and energy costs, core inflation has remained very tame. However, workers do have to buy food and gas.

Unit labor costs are the ratio of hourly compensation to labor productivity; increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them. Real hourly compensation is equal to hourly compensation divided by the consumer price series.

In other words, even though it cost companies more in labor costs to produce a unit of stuff, after inflation workers were worse off. As the graph below shows, productivity growth has come down, and unit labor costs have risen, but from extremely high levels in the case of productivity and very low levels in the case of unit labor costs (they do tend to have somewhat of an inverse relationship).

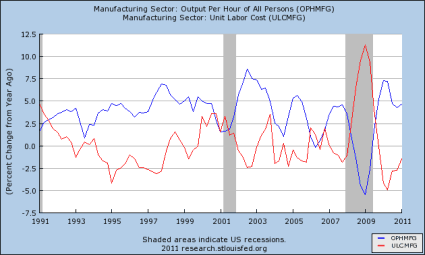

Manufacturing sector productivity continued to be outstanding. It grew 6.3% as output and hours worked increased 9.7% and 3.3%, respectively. Year over year, manufacturing productivity increased 4.7%. Unit labor costs in manufacturing declined 3.5% for the quarter, and 1.4% year over year.

Most of the gains from productivity continue to go to capital in the form of higher profits, not to labor in the form of higher wages. This is the key reason that corporate net margins have been doing so well lately. Rising net margins are the driving force behind the extremely strong earnings growth of the last two years. For an extensive analysis of the trend in net margins among the S&P 500, including sector by sector breakdowns see “Another Superb Season”.

With in manufacturing the real star is among the Durable Goods makers, such as Ford (F) Durable Goods productivity increased 9.8%. At Non Durable Goods makers, such as Procter Gamble (PG) productivity growth was lower but still very respectable at 4.5% for the quarter.

Durable goods increased output by 16.4% and did so while increasing hours worked by just 6.1%. Non-durable goods production rose 3.3% while hours fell 1.2%. On the unit cost front, durable goods saw a 6.7% decline for the quarter and a 3.4% year over year drop. Non-durable goods manufacturing saw a 2.2% decline for the quarter, and a 0.8% decline year over year.

The rise in non-durable output is not going to provide any help on the employment front. The next chart shows the year-over-year changes in overall manufacturing productivity and labor costs over the last twenty years.

Despite the slowdown from the fourth quarter (and from the third and second quarters for that matter) this was a very solid report. Productivity came in better than expected, and last quarter was revised higher. While unit labor costs were higher than expected, that bad news was more than offset by the downward revision to the fourth quarter.

Over the long term, nothing beats a high rate of productivity growth. If GDP is growing simply because the population is growing, it is not much of an achievement. On average, the people are no better off. The key to raising income per capita is to increase the amount (or value) of the stuff you can make in an hour of work. However, when unemployment is high, the same number of people being able to make more stuff does not exactly help.

Most of the benefit to higher productivity continues to go to companies in the form of higher profits, not to workers in the form of higher wages, thus even those who are working are not seeing much of a benefit from increases in output. The big winners from higher productivity are shareholders. Rising productivity is driving very strong earnings growth, and that earnings growth is the primary reason that the stock market has been rising so much over the last two years.

Productivity growth has been particularly strong in manufacturing, particularly in Durable Goods. The year over year increase in compensation is only slightly higher for Durable Goods workers than for non farm businesses as a whole at 3.4% versus 2.5%.

While the report does not break out service sector productivity and unit labor costs directly, given the extremely strong performance in manufacturing, up 6.3% on the quarter, relative to just 1.6% growth for non-farm business as a whole suggests that service sector productivity is downright anemic, and perhaps even negative.

The same could be said about the 3.5% drop in manufacturing unit labor costs relative to the overall 1.0% increase. This clearly suggests to me that the manufacturing side of the economy is going to have much stronger earnings growth than the rest of the economy. That suggests that sectors like the Industrials and Autos should be good places to invest.

FORD MOTOR CO (F): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply