Apple Inc. (AAPL) is the first chart I look at almost every morning of my career and if you watch the Morning Call you see I cover it in some form almost every show. The reason I like to look at and trade Apple is that it trades very well technically, providing active traders with good, calculated and measured moves.

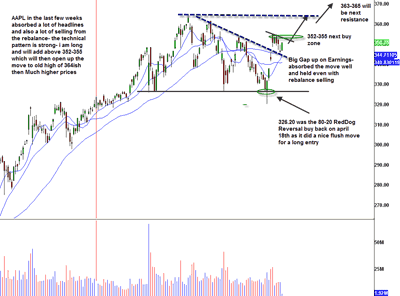

Back on April 16th my RedDog reversal strategy triggered for a buy into support around $326.80. Then company came out and reported very impressive earnings this quarter and stock responded well and gapped up into resistance. AAPL reported record EPS of $6.40,. a 95% surge in quarterly profits, and topped revenue estimates by more than 1 billion dollars, largely in part to strong iPhone sales. The iPad 2 arrived in Japan last week and is coming to 11 new countries today, with the tablet looking to be the next big money maker for Apple.

(click to enlarge)

Since then it’s held the earnings gap and absorbed a lot of bad news. Uncertainty over Steve Jobs’ future with the company is the darkest cloud, while supply chain concerns in Japan have also surfaced. More recently index rebalancing has triggered weakness in the stock, as its Nasdaq weighting went from 20% to 12%. This rebalancing will end at the close today.

I think you can tier one AAPL in this $345-350 area, and then add for a momentum tier once it clears $352-355 at some point in the next few sessions. This will take us to the old resistance around $364 then new highs to my ultimate target this year around $420-450.

Disclosure: Long AAPL

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

In the conference call, they said that they expected no issues from the Japan quake to impact either production capacity or cost.

This will never happen. Time to switch and buy BIDU or SINA or YOKU

An interesting article.

I think the index is actually called “Nasdaq-100”.

It will be interesting to see what the related ETF called QQQ will do.

The white iphone was having problem. HOw can it reach new highs. It will turn black when it is being too hot.