The last Atlanta Fed poll of small businesses in the Southeast suggested an uptick in confidence late last year. A similar upturn has been noted in the National Federation of Independent Business’s survey of its members conducted in February of this year and released in March. This upturn is good news for the U.S. economic outlook, as small firms are one group that has lagged the economic recovery.

It’s also good news, given the continuation of unimpressive readings from last week’s release of the Quarterly Census of Employment and Wages (QCEW) for the second quarter of 2010. As we have noted previously and highlighted in this recent Wall Street Journal blog post,

“The recession caused a sharp decline in new business start-ups, intensifying job market losses and potentially putting future economic growth at risk.”

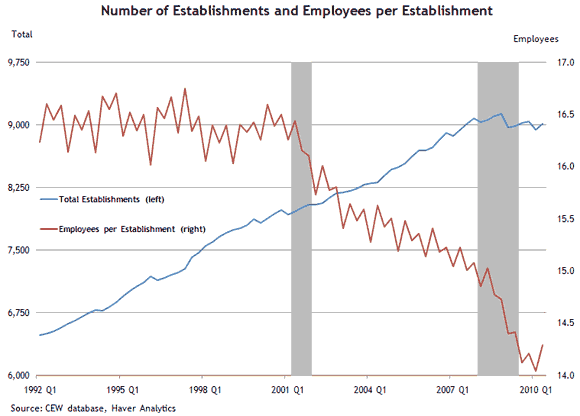

The QCEW data also showed that the number of business establishments with payrolls in the United States has remained stuck at around 9 million since late 2007. By comparison, in the early 1990s there were about 6.5 million establishments, a number that rose to close to 8 million in 2000 before peaking at 9 million 2007.

The net creation of business establishments—that is, physical locations for conducting business such as manufacturing plants, retail stores and business offices—has in the past been a key ingredient in job growth in the United States. This growth is driven partly by demand from newly created businesses and by mature firms expanding their footprint by opening additional locations. The demand for physical space is also clearly important to the commercial real estate industry, which has been burdened by elevated vacancy rates in many markets and generally low demand for new space.

Another trend from the QCEW data is striking—the number of employees per establishment is much lower than it used to be. The average size of U.S. establishments was relatively stable during the 1990s, at around 16.5 employees per physical location. The 2001 recession was associated with a decline in the average size to about 16 workers per establishment, and the average size continued to track lower during the last decade, moving down to about 15 employees per establishment in 2007. The latest reading for the second quarter of 2010 was 14.3 workers per establishment, up from 14 workers in the first quarter.

Several possible explanations exist for these declines in average establishment size. First, there is a cyclical response to weak demand as firms cut their payrolls. Second, productivity gains over time allow a plant, store, or office to support the demand for its goods or services with fewer workers. Third, there is a secular trend away from industries that have a large average establishment size, such as manufacturing.

If one digs into the data, only one major sector has experienced a rise in average employment per location over time—health care. This growth is likely a result of increased demand for health care services, and those services are primarily embodied in the staff at doctors’ offices and hospitals. Manufacturing, on the other hand, has witnessed dramatic declines in average plant size. During the 1990s, average plant size was relatively stable at around 43 workers. The average size then declined to about 38 workers following the 2001 recession and remained around that level through 2007 before declining again and reaching an average size of 33 workers per plant in the second quarter of 2010. This trend appears to primarily reflect a combination of secular shifts away from labor-intensive types of manufacturing where productivity gains have already played out—some apparel manufacturers, for instance—and sharp cyclical downturns.

Of course, something will have to give if there is employment growth—primarily more and/or larger establishments. Consider the following thought experiment: if the average size of establishments returns to the prerecession level of 15 workers per location, and private-sector jobs are added around a pace of 2.4 million a year pace (or 200,000 jobs a month), then we would see establishment growth return to the 1992–2007 average of about 160,000 per year. Clearly, we are currently far below that trend.

Leave a Reply