As I promised to do here, I am posting a sequel to my original column: Ron Paul’s Money Illusion. I want to thank everyone who took the time to comment and criticize the views expressed there because it has led to me to sharpen my thinking on the matter. I doubt that what I have to say here will sway opinion one way or the other, but I at least hope that the nature of my criticism will be more clearly understood.

The purpose of my original post was to critique a statement I’ve heard Fed critics repeat ad nauseam. The statement can be found in Paul’s book End the Fed (p. 25):

One only needs to reflect on the dramatic decline in the value of the dollar that has taken place since the Fed was established in 1913. The goods and services you could buy for $1.00 in 1913 now cost nearly $21.00. Another way to look at this is from the perspective of the purchasing power of the dollar itself. It has fallen to less than $0.05 of its 1913 value. We might say that the government and its banking cartel have together stolen $0.95 of every dollar as they have pursued a relentlessly inflationary policy.

I think that the first part of this statement is true, so I do not wish to dispute this fact. On the other hand, I think that one might reasonably ask whether this fact alone should be a source of great consternation (especially in the presence of other, more pressing, policy concerns). As for the final sentence in the quote above, well, I think it is just plain false. Now let me explain why I think all this.

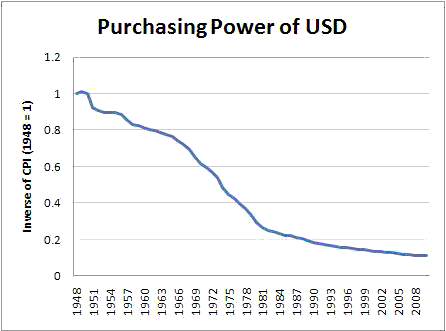

Let me begin with the picture most popular with end-the-fed types–a graph depicting the declining purchasing power of the USD. I use postwar data without loss of generality, since most of US inflation has happened since then.

This picture plots the inverse of the price-level (as measured by the consumer price index). I have normalized the price-level to $1.00 in 1948. It falls to roughly $0.11 in 2010. This corresponds to roughly a nine-fold increase in the price-level or about a 4.6% annual rate of inflation. (Note that the rate of inflation has slowed considerably since 1980).

The picture above is used by some end-the-fed types to great effect in generating anger and fear among some members of the population. Anger via the claim that the Fed has stolen 90% of (the purchasing power) of your money; and fear through the prospect of this purchasing power approaching zero in the not-too-distant future.

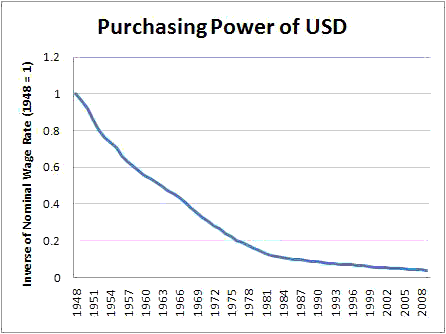

Graphs like the one above have their uses. But one should not get too carried away with a single picture. Let me draw you another picture. This one plots the inverse of the U.S. nominal wage rate (total nominal wage income divided by aggregate hours worked).

This graph plots the purchasing power of the USD, where purchasing power is now measured in terms of labor, rather than goods. This graph shows that you need a lot more money today than you did in 1948 to purchase 1 hour of labor. Another way of saying this is that the average nominal wage rate in the U.S. has increased by a factor of 25 since 1948. Is this a cause for alarm?

No. In fact, there is very little one can conclude from these pictures, which are plots of nominal variables. We need more information than this to make any substantive statements about the impact of nominal wage and price dynamics. In the absence of money illusion, people care about real variables–not nominal variables. To put things another way, people eat bread, not money. The nominal price of bread, in of itself, is an uninformative measure. What would be informative is its nominal price in relation to one’s nominal income (or wealth). The first graph above has nothing to say about how nominal incomes have evolved.

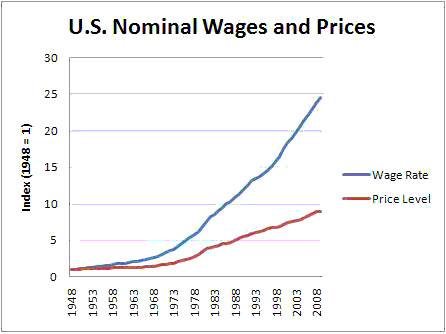

Let me now combine the two graphs above into one picture, with both series inverted, and with both the price-level and nominal wage rate normalized to $1.00 in 1948 (the actual nominal wage rate was $1.43).

According to this (publicly available) data, the price-level (CPI) has increased by about a factor of 10 since 1948. But the average nominal wage rate has increased by a factor of 25. (There is, of course, considerable disparity in wage rates across members of the population. But I am aware of no study that attributes significant wage or income heterogeneity to monetary policy. Of course, if readers know of any such studies, I would be grateful to have them sent to me.)

The figure above implies that the real wage (the nominal wage divided by the price-level) has increased by a factor of 2.5 since 1948. This is undoubtedly a good thing because it implies that labor (the factor we are all endowed with) can produce/purchase more goods and services. More output means an increase in our material living standards (Though again, I emphasize that this additional output is not shared equally. But surely a laissez-faire world advocated by some is not one that would generate income equality either.)

Now, an interesting question to ask is how the picture above might have been altered if the price-level had instead remained more or less constant. Judging by the emails I receive, many people evidently believe that the nominal wage path depicted above would have largely remained the same (that is, they apparently seen no connection between nominal wages and the price-level).

If this was indeed true, then the average real wage in America would have increased by a factor of 25, instead of 2.5 under a regime of price-level stability. And if you believe this, or something close to it, then the conclusion would indeed be startling: the inflation generated by the Fed has apparently served only to reduce the purchasing power of labor (diverting resources to powerful capitalists). This claim–or some variation of it–is implicit in the quoted passage above.

I suggested, in my original post, that there is reason to believe that under an hypothetical regime of price-level stability, the nominal wage rate in the graph above would instead have ended up increasing only by a factor of 2.5 (more or less)–the factor by which real wages actually rose. This is what I meant by my claim of long-run neutrality of the price-level increase; and it is also what I meant by Ron Paul’s Money Illusion (which is subtly different than claiming the superneutrality of money expansion; more on this later).

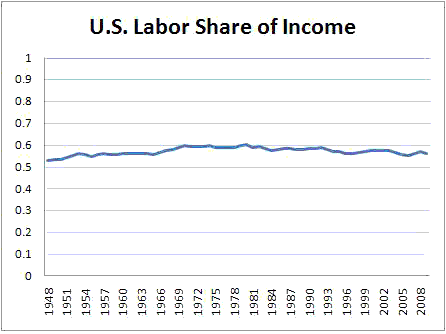

Some evidence in favor of my “long-run neutrality view” is to be found in the time-path of labor’s share of income (GDP):

I see no evidence in the data here that our higher price level today has whittled the share of income accruing to labor. Moreover, I see no evidence suggesting that episodes of high or low inflation are related in any systematic way to the resources accruing to labor. (In fact, I see some evidence of a rising labor share during the high inflation decade of the 1970s.) But perhaps other data tells a different story. If so, I’d like to see the data (i.e., instead of a short email claiming that I am wrong).

And what about the effect of inflation on the return to saving? I received many emails like this one:

Please, Mr. Andolfatto explain to me how this works out for someone who has been a careful saver of his money and now sees the purchasing power of that money destroyed? Please explain to me how this works out for a retired person on a fixed income who sees the declining purchasing power of that income?

These are good questions. The way they are asked suggests that I am in favor of inflation. I am not. It’s just that I do not want to overstate the economic significance of inflation. Especially a low and stable inflation rate regime, like the one we have been living in for the past 30 years. And especially in light of what I view as potentially much more significant economic problems.

The concern expressed above would certainly be valid if the following was true: [1] if many people are forced to save in the form of zero-interest cash; and [2] if inflation is high and volatile. There are many episodes in history where savers have been hurt by an unexpected increase in inflation. I do not wish to defend the actions of any agency responsible for episodes of high and volatile inflation. And certainly, there are many economists within the Fed that are critical of past (and even current) Fed policies.

But this is not the regime we currently live in. As I said, inflation has been (relatively) low and stable for over 30 years now. And the Fed is committed to keeping inflation to keeping inflation “low and stable” (implicit inflation target is 2%). The argument that a “careful saver” over the last 30 years “just now” sees the purchasing power of that money destroyed seems implausible to me. Most people do not hold the bulk of their savings in the form of cash. (And if people were holding their savings in the form of Treasury bonds, they would have experienced significant capital gains over the last couple of years with the decline in nominal interest rates.) I think its fair to say that most people, or the people who manage their money, expect inflation. Market-based measures of inflation expectations show that inflation expectations are currently around 2%; see here.

I might add, as an aside, that in the emails I received promoting this line of argument, the writer typically professed concern for the “poor and unsophisticated saver.” It was interesting to note that in each and every case, the writer him/herself was always very eager to point out their own sophisticated saving behavior–having, for example, invested in gold and silver (as I show here, you would have done better investing in stocks).

Well, and what about those on fixed incomes? The writer above mentions retired persons on fixed incomes. I presume he means nominally fixed pension benefits? (These benefits are generally indexed to inflation, though perhaps imperfectly.)

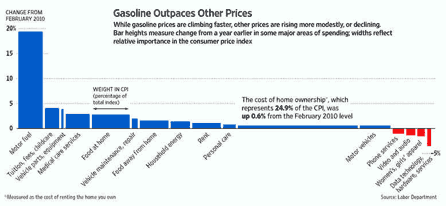

I think that a lot of the concern here is with respect to the fact that the prices of some goods (like food and energy) have recently risen very sharply and that, for most people, there is no correspondingly sharp increase in nominal incomes. People are right to be concerned. Here is an interesting picture from the WSJ:

(click to enlarge)

The data show that some prices are rising rapidly. Some prices are not moving much at all. And some prices are even falling. In short, there are economic forces at work that are changing the system of relative prices. These relative price changes reflect fundamental changes in the structure of supplies and demand in the world economy. These changes would occur whether the Fed was in existence or not. Indeed, we expect relative price changes to be a normal part of a laissez-faire economy.

Finally, someone posed the following question to me:

Please explain to me how this (inflation) works out for the rest of the country when Wall Street bankers are the first to get their hands on newly printed Fed money, so that they can bid up all kinds of prices, including rents on apartments, which makes it difficult for anyone but a Wall Streeter to afford to live in Manhattan?

There is no persuading the people who organize their worldview around a web of conspiracy theories, but let me try anyway. First, this makes it sound like the Fed simply hands out cash to people. It does not. The Fed is not permitted to hand out cash in exchange for nothing in return. When the Fed creates new money, it uses the new money to purchase assets from another party. The Fed engages in asset swaps; there are no “helicopter drops.” (It is the government that injects money into the economy via purchases of goods and services.)

Indeed, the business of banking is mainly a business of creating liquidity through asset swaps (e.g., when you take out a mortgage, a private bank creates and lends you book-entry money in exchange for your house as collateral). Even in a private banking system, someone must be the first to get their hands on newly created money. Even under a gold standard, someone will be the first to get their hands on newly discovered gold. And as for the price of real estate in Manhattan…I’m not sure what to say. It is one reason why I live in St. Louis!

I want to return to the last sentence in the End the Fed quote above:

We might say that the government and its banking cartel have together stolen $0.95 of every dollar as they have pursued a relentlessly inflationary policy.

This claim is simply false. Let me explain why.

Monetary economists make a clear distinction between base money, broad money, and wealth. The layperson typically makes no distinction between “money” and “wealth.” Wealth is denominated in dollars. But this does not mean that all wealth is in the form of dollars (most of it is in the form of physical capital). Most people will interpret “dollars” in the quoted passage above to mean “wealth.” Thus, the statement de facto claims that the Fed bears responsibility for stealing 95% of our wealth. This is a preposterous claim.

It is true, however, that something has lost 95% of its value since 1913. But just what is this something?

Answer: It is the outstanding stock of base money in the year 1913. (One dollar created yesterday, for example, has not lost 95% of its value as of today.) This 1913 money stock constitutes a tiny fraction of our total wealth. Moreover, since it has been in circulation for almost 100 years (much of it held by banks themselves in the form of reserves), the loss in its purchasing power has been spread over countless individuals, agencies, and generations.

Having said this, it remains true that inflation constitutes a tax. Seigniorage revenue refers to the purchasing power the government creates through the act of creating new money. Seigniorage revenue is also sometimes called an inflation tax. As far as taxation goes, seigniorage in the U.S. is small potatoes; see here. It constitutes a tiny fraction of government revenue (the bulk of which comes in the form of direct taxation).

Some people wonder how this is the case today, given the massive expansion in the Fed’s balance sheet. The short answer is that seigniorage comes from permanent increases in the supply of new money (where the new money is ultimately used to purchase goods, rather than assets). The Fed, in its commitment to keep inflation “low,” has implicitly promised to unwind its balance sheet at some point in the future should circumstances dictate. (Unwind in the sense of selling off its accumulated holdings of income-generating assets in exchange for base money).

If the Fed maintains its credibility (and this will be the hard part going forward), then there is little reason to expect even a huge temporary increase in the supply of base money to have an explosive impact on inflation (Japan’s own quantitative easing experience provides an excellent example of this). This is, of course, something that the Fed monitors very closely.

To conclude, I think that the “currency debasement hurting the poor unsophisticated saver and man-on-street wage earner” argument is largely overstated. The assertion that “the Fed has stolen 95 cents of every dollar” I view as absurd. There are legitimate criticisms one could level at the monetary institutions of this country, but these are not some of them.

There are fundamental market forces at work in today’s world that are causing the return to labor, saving, and entitlements to vary over time. I think that there is good reason to believe that these fundamental or “real” factors are much more consequential than the monetary or “nominal” factors emphasized by some people. But this topic is best left for a future column.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

“The Fed engages in asset swaps; there are no “helicopter drops.” (It is the government that injects money into the economy via purchases of goods and services.)”

Where does the government get its money from?

Who is the largest holder of US treasuries?

Is it true that when the Federal Reserve creates money and loans it to banks, they can just buy treasuies with it?

“The concern expressed above would certainly be valid if the following was true: [1] if many people are forced to save in the form of zero-interest cash; and [2] if inflation is high and volatile.”

A savings acount will get you 1% interest.

You have stated that the inflationary goal is 2%.

How is this anything but theft?

Nicely writen! Hope to see some counter aguements :).

Mr. Andolfatto,

Although I disagree with many of your interpretations and conclusions, I wanted to compliment you on your well-articulated opinions and general civility this time around.

Rather than debate you, which I doubt would not sway your opinion much if at all, I would like to ask your opinion of the video available through this link: http://danieljmitchell.wordpress.com/2010/12/04/great-video-exposing-failures-of-the-federal-reserve/

Regards,

Charles

If the US dollar was backed by gold are purchasing power would be massive. This would prevent the Global elite bankers from stealing are currency by printing fiat currency. Ron Paul is more for allowing competing currency and allowing the fed to still operate for now, but the Fed would soon find itself out of business because no one with a half a brain would want to hang onto a federal reserve note. Especially when they found different fiat currency that were valued in gold which always increases. Gold and especially silver has kicked the stocks market ass even though it really should be higher. I;m not going to get into that though. Libya currency is still backed by a significant amount of gold probably just one out of several reasons were invading them.

Mr.Andolfatto

IT WILL BE ABOLISHED!

V for Victory

Mr Andolfatto,

Your article was more civil this time, well done.

Let’s cut to the chase, RP wants competing currencies, Gold and Silver to circulate as per the constitution, Why the hell you have a problem with that has got me beat?

With regards to you blaming just the Govt, well I beg to differ and please feel free to reply me if you wish. The Federal Reserve has been purchasing toxic assets from its member banks, the so called assets are considered as reserves in the same class as Treasury bonds, asset reserves are the mechanism by which the Fed creates 90% of its new money – the other 10% being created at the time of purchase of the asset reserve. As you would well know.

Two points: First, When you consider the increase in productivity, because of technology or just plain better ideas, the amount of labor needed to buy things like food, clothing, housing etc. should be a tiny fraction of what it was before the feds., and of course it isn’t.

Second. The idea that it is OK for the dollar to lose purchasing power as long as wages keep up fails to take in to account the competitive disadvantage this puts us in with labor and products overseas. Lower wages may not be the only reason companies move overseas, but it plays an important part.

‘The Fed engages in asset swaps; there are no “helicopter drops.” ‘

But wouldn’t asset swaps keep the prices of “troubled assets” above their real value? Doesn’t sound like a good idea, I doubt the Fed is getting lots of good assets for its recently printed money (TARP? Need we say more?)

‘It is the government that injects money into the economy via purchases of goods and services.’

Isn’t that the tip of Paul’s ultimate point in the book? The Fed’s ability to print money allows the government to purchase goods and services no one wants, go practically bankrupt doing it, then print more money to cover even bigger versions of their failed projects:

Amtrak trains that break down en route to a ribbon cutting.

Hopeless drug wars.

More foreign wars.

Really expensive schools.

Crony green energy initiatives (Chevy Volt? Serious Materials? GE Projects?)

I think Ron Paul has provided a good compromise by attempting to (re)legalize gold and silver as legal tender. If THE FED is as vitally important as you assert, is should then easily survive competition with pieces of metal. I think you should vouch for legalizing bullion, just to show everyone how confident and correct you really are…..

If the Fed controls America then they have failed. You Wall Street fellows are smart just fix it, fix it now, or get rid of it and replace it. The system failed, lets put the Fed under investigation and see what the real story is. Can you make that happen?

inflation has been low and stable for over 30years?

milk in NJ has gone from under 3.00 to over 4.25 in about 3 years…..how do you explain that?

Generally put, the price of tuition rises slower than gas, because one chart from one month from 2010 says so. And, besides that, students are richer than ever, because they have credit cards; banks wouldn’t give students credit cards if the students weren’t rich/smart enough to use them properly.

Btw, debt is not a tax, so it’s really not important, and that’s why I’m not going to talk about it. I mean, that is why the government doesn’t care about the trillions worth of debt nor the quadrillions worth of derivatives, such things have no effect on Americans, so … move along everybody: the economy is just fine; the Federal Reserve and the people that run it aren’t crooks; Ron Paul doesn’t know anything, because he is not an economist!

/s

“According to this (publicly available) data, the price-level (CPI) has increased by about a factor of 10 since 1948. But the average nominal wage rate has increased by a factor of 25.”

David,

I see some major flaws in your analysis. First of all, it would be far better to analyze the trends from 1913 onward, rather than the somewhat arbitrary date of 1948 (why did you pick that year?). Secondly, your above statement assumes that the nominal wage growth out-pacing inflation is somehow attributable to the Fed’s loose monetary policy. Nonsense. If we were on sound money, it is likely that real wages and real wealth would have outpaced price increases by an ever greater margin. The growth in wealth occurred in spite of the Fed – not because of it.

You seem to imply that while bread price has increased 10 times, people have 25 times as much income with which to buy the bread.

We have only our after tax income available to buy bread. Do you use gross income or net income after all taxes?

My understanding is that the CPI is calculated differently each year. I would like to see what happens to the price level with a constant basket of goods in the CPI.

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard

Alan Greenspan

You don’t discuss at all the vicious bust and boom cycles that are created in shorter term time frames. This would not be reflected in a view that is out over the longer term. (if your data is even accurate) The inflation of commodity prices, the housing market, etc.. is all driven by the recklessness of the Fed. Banks were throwing out all kinds of ridiculous loans because money was so cheap thanks to the Fed. Volatlity in short-term cycles is a huge problem as wages obviously can’t keep up with massive inflated prices like oil, housing, education, insurance, etc…

The other thing you fail to mention is that a 50% decrease in the market and 50% increase in the market does not get one back to even. This is what has happened by the recent money pumping scheme of the Fed. I have no doubt we will see another huge decrease in the market again, once the money printing ends.

Ron Paul 2012, The Revolution will succeed. By the way UTAH just legalized GOLD and Silver as legal tender Booyah, Baby FU Federal Reserve