In December, Personal Income rose 0.4%, matching the 0.4% rise in November, and just below the 0.5% increase in October. However, both November and October were revised up by a tick, so relative to where we thought personal income was, this is actually an acceleration. It was, on the other hand, slightly below consensus expectations of a 0.5% increase.

Meanwhile, Personal Consumption Expenditures (PCE) rose by 0.7%, higher than the consensus expectation of a 0.6% rise. That is an acceleration from the 0.3% rise in November but matched the rise of 0.7% in October. Of course, if spending is rising faster than income, it means that the savings rate is falling. It fell to 5.3% from 5.5%.

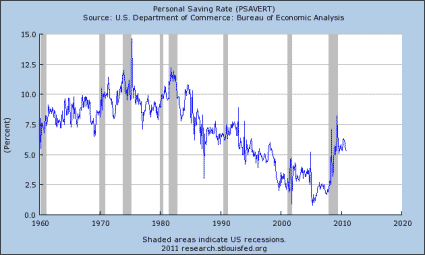

The savings rate, while still well above the dangerously low levels that prevailed from 2004 to 2008, has declined every month since June when it hit 6.3%. The graph below shows the long-term history of the savings rate.

Over the long run, a higher savings rate is good for the country, and is desperately needed as the savings rate has been in more or less a constant secular decline for the last 30 years. Without domestic savings, we have to borrow from abroad to invest in the economy.

Capital imports are the flip side of the trade deficit. If we sell less abroad than we buy, then we go into debt abroad. That is the same thing as importing capital.

The chronically low savings rate has left the country trillions of dollars in debt to the rest of the world. Note that is the 1960’s and 1970’s the savings rate was normally around 9 or 10%, and started a long secular decline after the 1982-83 recession.

From the Largest Creditor to the Largest Debtor

Prior to the 1980’s, the U.S was the world’s largest creditor nation by a large margin. Now we are by far the world’s largest debtor. The fall in the savings rate and the increase in our indebtedness is not a coincidence, it is a causal relationship.

The extraordinarily low savings rates in the five or six years leading up to the Great Recession were a disaster for the country, even though it made things seem good at the time. We suffering the hangover from that party now.

In the short run, on the other hand, a falling savings rate increases economic growth, and vice versa. If someone gets a raise, but does not spend more, then that raise does not stimulate other economic activity. If the raise is not spent, then there is no increase in aggregate demand. It either increases future potential demand, or pays for demand that occurred in the past (i.e. debt is paid down).

On the other hand, if people are socking away for a rainy day less than they were, it increases current demand. If people go out to eat rather than staying home, it means that there is more work for waiters and cooks.

Savings and “The Paradox of Thrift”

The question is how sustainable is the declining savings rate. The desire of consumers to sit on their wallets and not spend increases in income is very understandable. The collapse of housing prices destroyed trillions of dollars of wealth. That wealth people had been planning on using to finance their retirements or put the kids through college. Now that money has to be replenished the hard way, by spending less than you earn.

Note how the savings rate tends to rise during recessions. The very fact that more people decide to save is one of the reasons recessions are, well, recessionary. While on an individual basis, being thrift is a good thing, and so is paying down your debt. However, if everyone decides to do it at the same time, it is a very bad thing.

This is what Lord Keynes called “The Paradox of Thrift.” It is the change in the savings rate — not the level — that causes the pain. While the current decline in the savings rate is welcome for the short term, it is not healthy in the long run. We need more domestically formed capital, rather than relying on importing capital from abroad. Importing capital is the flip side of running a trade deficit.

The rise in the savings rate during the Great Recession was very rapid, and was one of the key reasons the recession was so severe. We are still a long way from the sort of savings rate we had back in the 1960’s and 1970’s, but we are a lot closer than we were a few years ago. Slowly people are making progress on repairing their balance sheets, or at least they have over the last year or so. That progress, however, could be greatly undermined if the price of houses starts to go south again.

“High Quality” Personal Income Growth

The increase in Personal Income, while lower than expected, was of high quality. In total, personal income rose by $54.5 billion, a nice increase from the rise of $44.9 billion in November (seasonally adjusted annual rates, as are all the subsequent numbers on the components of personal income).

In December, private sector wages rose by $15.5 billion, up from a $5.9 billion increase in November. Wages in the goods producing sector increased by $1.5 billion in December, partially reversing a $2.5 billion decline in November. Wages in the private service sector were up $14.0 billion versus an increase of $8.4 billion in November.

Overall government wages rose by $1.6 billion after rising $1.3 billion in November. Private wages and salaries are the most important, and highest quality, form of personal income. Government wages have to be paid out of either taxes or government deficits. Government workers do, however, spend their money in the private sector, just like private sector workers do.

Proprietors’ Income

Another important source of personal income is proprietors’ income. In other words, what the self-employed and small businesses were earning. That increased by $8.1 billion in December, on top of a $7.9 billion increase in November. Farm proprietors incomes rose by $2.8 billion, on top of a $2.7 billion increase in November.

Farm vs. Non-Farm

Strong commodities prices have led to a stunning increase in farm incomes. Farm proprietors incomes have risen every month since May, and over that period they are up 56.6%. The overall strength down on the farm helps explain why the Great Plains states like the Dakotas and Nebraska are weathering the downturn so much better than the rest of the country.

It is also a good sign for firms that are tied to the farm economy, such as Deere (DE) and Potash (POT). It further suggests that perhaps Willie Nelson may need to find a different recipient for his charity concerts.

Non-farm proprietors income rose by $5.2 billion, matching the $5.2 billion rise in November. In other words, what we normally think of as small business income is showing signs of getting back on track, but is hardly booming the way farm income is. Farm proprietors income is tiny relative to non-farm at just $60.9 billion versus $1.0303 trillion. Since June, non-farm proprietors income is up a nice, but hardly exciting 2.4%.

Other Sources of Income

Rental income rose by $ 1.9 billion in December, up from a $1.7 billion increase in November. Rental income has increased every month since May. The total increase since then is 4.4%. This suggests to me that we are in the process of bottoming in the real estate markets.

Capital income, or income from dividends and interest surged by $21.9 billion in December on top of a $17.3 billion rise in November. This income is particularly important to retirees. While interest rates are still very low by any historical measure, they have increased over the last few months, most notably longer term T-notes.

Interest income increased by $13.6 billion in December, matching a $13.6 billion rise in November. This was the third month in a row of significantly higher interest income, but that only partially reverses earlier declines. Since September, interest income is up by 3.5%, but since June it is still down 0.5%.

Dividend income actually rose by $8.3 billion after rising $3.6 billion in November. Dividend income can be a bit erratic month to month, but the general trend seems to be upwards, since May total dividend income is up by 3.0%.

Government Transfer Payments

The final big component of personal income is government transfer payments. Like government salaries, this source of income has to come from either taxes or increased deficits and so it is a less desirable source of personal income from the point of view of the economy as a whole.

However, it is still income that gets spent in the economy. Wal-Mart (WMT) really doesn’t care if the money spent in its stores is from the elderly using their Social Security checks or the dividends they get from their investments, or really if it is retirees shopping there or people still in their working years spending their wages there, or their unemployment benefits.

Transfer payments were up again this month, rising $3.8 billion in December, after rising $8.7 billion in November. Since August, though, this has not really been a major force in the total increase in personal income — up just a total of $5.9 billion, or less than 0.03%.

Higher Social Security and Medicare benefits (up $17.7 billion since September) and “other transfer payments” (up $12.5 billion) have been offset by a sharp decline in unemployment benefit income, dropping $6.0 billion in December after a $2.4 billion rise in November, but down $25.4 billion, or 16.9% since September.

Over the long term though, the economy cannot simply grow through ever increasing amounts of money being handed out by the government. Those payments are very useful in the short run to help hold up overall consumer spending when the economy has turned soft.

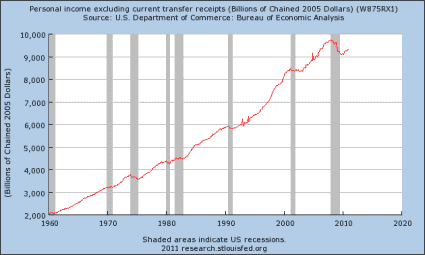

In the long run, the economy needs income from wages and salaries, and from small businesses earning profits. It is those earnings and profits that pay the taxes that support the transfer payments. It is then worth looking at personal income excluding transfer payments, as shown in the second graph.

Since it is a long-term graph, inflation plays a much bigger role over time, and the graph is based on real personal income rather than nominal (which the rest of the numbers in this post are based on). Not that during most recessions (and the immediate aftermath) incomes excluding transfer payments flatten out, but do not fall significantly.

The Great Recession was very different in that regard, with income ex-transfer payments falling by 6.67%, in real terms, between 12/07 and 10/09. We are now starting to see a very tentative recovery in it, up 2.60% from the 10/09 low.

Overall: A Positive Report

Overall, I would have to rate this report as positive. While income was up slightly less than expected, the overall quality was quite high. Only 9.7% of the increase in personal income came from higher transfer payments, down from 19.4% in November. Between May and October, 28.9% of the total increase in personal income came from higher government transfers.

The big increase in PCE, rising $69.5 billion in December on top of a $35.4 billion increase in November, was reflected in the big contribution that consumer spending made to GDP growth in the fourth quarter. The increase in personal income is coming from sustainable sources like higher wages and salaries, most notably from the private sector, and from higher proprietors incomes.

In other words, small businesses are starting to do better, even non-farm small businesses. The higher income from interest payments is a bit of a two-edged sword, but is certainly welcome to retirees. Growth in dividend income is likely to continue as firms share their strong earnings growth with their shareholders.

The decline in the savings rate is a bit troublesome over the long term, but is welcome right now in getting the economy back up closer to potential.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply