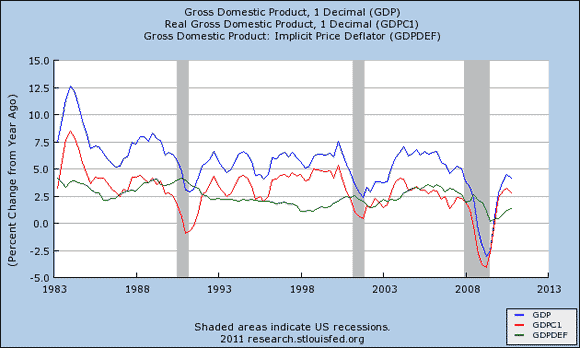

This figure makes it very clear why: changes in nominal spending get translated largely into changes in real economic activity. Its impact on the price level is far less.

Of course, in an environment where inflation expectations get unanchored, like the 1965-1979 period, nominal spending shocks will have a greater impact on the price level and less influence on real economic activity. And, over the long-run the trend growth rate of the real economy is determined by real factors. But for business cycle considerations, it is hard to argue with a monetary policy goal of stabilizing nominal spending when looking at this figure.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply