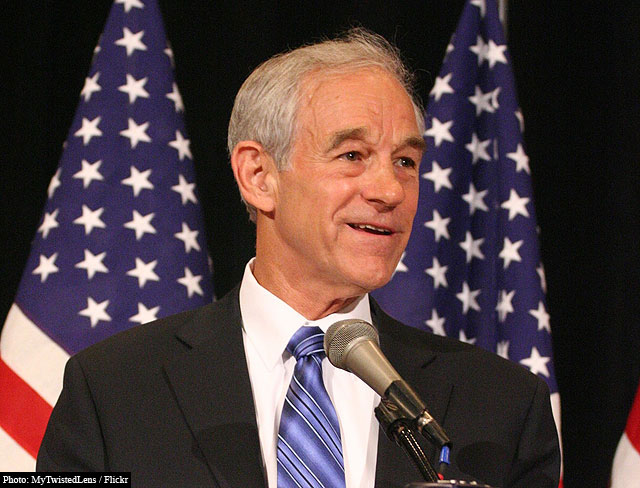

Recently I was asked whether Ron Paul might be able to reign in the Fed in 2011. I am hoping Ron Paul can expose the Fed’s activities with foreign banks, and also with gold swaps. I think that is about all he can accomplish. It might help add to popular anti-Fed momentum and build awareness. His actions could set off a chain of events in Europe that would be contractionary in nature.

I am much more concerned with the level of money substitutes than I am for the monetary base. If successful, Ron would trigger a contraction in money substitutes, because the ECB might not be able to print and the Fed could be constrained from QE by public opinion. But big forces are aligned against that eventuality. Socialism is more likely to succeed in an inflationary environment.

I would not want to live in an era where fiat money remains the norm and it contracts. It would be much more brutal than living under a gold system, which naturally expands slightly annually. My best guess is that the system continues to issue credit and have interventions regardless of Ron Paul, until at some point awareness (driven by highly palpable events) is such that the legal tender we use is either defunct (small chance) or watered down but reset with gold backing (higher chance). That would clean the debt slate and enable the global economy to reboot. Either way, there would have to be horrific events in the credit market, or staggeringly more massive interventions (QE3, ECB bailouts), to get the public behind such a reordering.

I sharply disagree with those who forecast a repeat of the 1970s inflation, who point to the big additions made to the monetary base. High powered legal tender and even M2 is less relevant than the broad supply of money substitutes, since the public (and anyone else) can’t differentiate between a money substitute dollar and a high powered one. Another way of saying this is the monetary base is just as worthless as the bank deposits it “supports.” Broad money, which mostly consists of these substitutes, has been contracting.

The theory that the monetary base is relevant stems from the old practice of having real money (gold & silver) lent out by banks as paper, which would expand or contract around this base through redemptions at the teller’s window. It is absurd to think anyone would go to a teller today and ask for a monetary base dollar, and the teller would have no idea what was being demanded. They are both counterfeit now. Meanwhile, Ben Bernanke understands the nuances between high powered money and broad money, and he is masterful at exploiting the lack of understanding of this crucial part of the monetary debate when he proclaims he is not printing money when he buys Treasury debt.

Increasingly a very small informed minority of the public is beginning to make the distinction between gold and legal tender. But at this point I have to say the investment community is far more enthusiastic about credit markets (and money substitutes) than it is about gold. The S&P has broken out of its downtrend relative to gold, for example. Oddly, it did so in the summer of 2008, prior to the meltdown.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Sorry to be such a spelling Nazi but it is “rein”, as in “the reins of the horse cart”. Unless, that is, you were deliberately trying to assign the connotation of “king” to Dr. Paul, in which case I would probably support you.

We’ll get consumer price inflation when the banks start lending again. It is the banks, not the Fed that create money. That’s the nature of a debt based fractional reserve system. So if you think about it, if you fear inflation, you had better hope we don’t have a recovery which motivates the banks to start lending again. One of life’s little ironies.

He’s made it clear many times that the dollar collapse will ultimately reign in the FED. However, it’s going to be enjoyable watching him make Bernanke squirm.

I for one greatly look forward to it!