The Santa Rally traditionally comes in mid December, but has it already started? This year we saw the seasonal strong period get off to an early start, in September rather than the normal November, which might be a harbinger of an early start to the year-end rally. Retail sales over Black Friday and CyberMonday were “way up” year-over-year, according to SpendingPulse, continuing a trend first gleened in September of increasing spending.

Before we get drunk with excitement, like our Santa here, a little caution. Friday’s unemployment disappointment included an increase in seasonal workers, up from last year, but still below pre-crisis levels, and on a seasonally-adjusted basis, still below normal. This means retailers are being cautious.

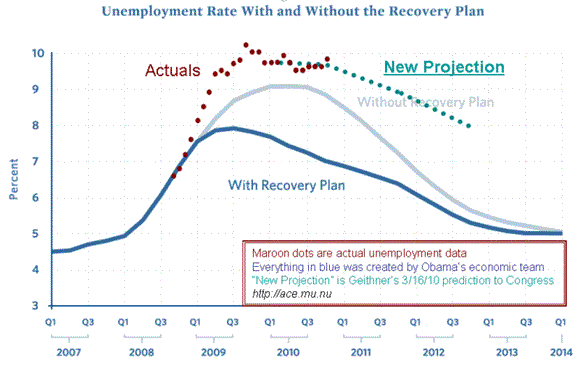

We all should be cautious about this recovery. Employment has been flat for a year, and you can see that the unemployment is ticking up slightly (the red dots in the next chart). Normally it ticks up as an economy recovers before ticking down, as workers on the sidelines come back to seek employment faster than new hires are made. A little of that is going on, but largely we have not seen job growth other than temporary or part-time work. This remains the Recoveryless Recovery.

We also should be cautious on stocks. We have a conundrum: possibly the early discounts pulled forward sales that normally would have happened in December; or perhaps the American shopper has now become so discount driven, we will see a pause in shopping until the retailers entice with even better discounts, giving a late surge to the holiday sales pattern. How to translate these choices into a prediction for the stock market?

Digesting the poor unemployment report

The poor unemployment report may put a damper on stocks over the next week, especially when it gets fully digested. For example, Saturday morning ZeroHedge summarized an appearance by David Stockman (Reagan’s budget director) on CNBC. He was a wet blanket back then, and he pours cold water over the current situation with this:

“[I]f you take core government plus the middle class economy (65 million jobs), that’s the breadwinning economy, if we take some numbers – how many jobs in the “core economy” in November – zero; how many jobs since last December: net zero; how many jobs since the bottom of the recession in June 2009: still a million behind from when the recession ended.”

As to whether the economy can grow without employment growth: “I can’t imagine how it can because employment growth generates income growth which is the basis for spending and saving ultimately and we are not getting income growth out of the middle class.”

And the stunner: the job “growth” has come almost exclusively from the part-time economy (two-thirds). Why is this a major problem: “there is 35 million jobs in that sector, with an average wage of $20,000 a year: that is not a breadwinning job, you can’t support a family on that, you can’t save on that. Those jobs will not generate income that will become self-feeding into spending.”

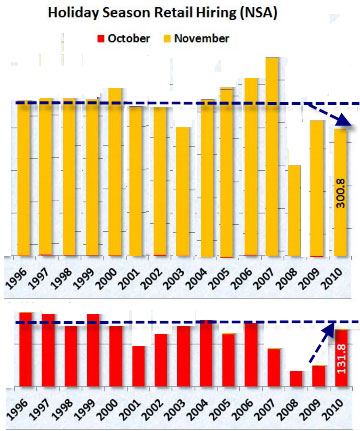

Slowing sales (or weaker than expected) could also dampen stocks. Mish took a deeper look at the unemployment report and found that October had been up over last year, but November ended down (see chart).

Slowing sales (or weaker than expected) could also dampen stocks. Mish took a deeper look at the unemployment report and found that October had been up over last year, but November ended down (see chart).

He found that the gushy unemployment report from October was due to the BLS inexplicably changing their seasonal adjustment bar, but this month restored it. You can speculate on whether this was really inadvertent, since it happened just before the mid-term elections, but the net of it is that the actual November hiring is the worst since 1993 other than 2008.

We might have had the spike in October because retailers ran their discounts and promotions early – well before the actual Black Friday – and so stocked up on temp workers. Neither bodes well for a sales surge through the end of the year.

Inventory Red Flag

Inventories are increasing faster than production. PragCap has charts and digs deeper: manufacturing ISM has been strong, which sounds promising, but the ratio of new orders to inventory is dropping. In prior periods where a strong ISM was overshadowed by an even larger inventory buildup, a severe recession followed.

It also appears that General Motors (GM) engaged in channel stuffing prior to its IPO. This would pump up manufacturing numbers despite anemic sell-through of cars. Even with auto channel stuffing, manufacturing jobs have now dropped for the past four months. It is a bit hard to sqaure this with the current Fed Beige Book, which is cautiously optimistic:

- manufacturing expanded in aloost all districts

- retail spending showed improvement

- hiring showed improvement

Seasonal Patterns

Historically the Santa Rally is not that dependent on macro conditions. We saw a strong December rally in 2008 before taking a dive in early January to the bottom in March 2009. We had a decent Santa Rally last year, which also peaked in mid-January. It tends to come in mid-December when a lot of serious market participants wrap up the year and head out for the holidays – markets tend to drift up on lighter volume.

Dead cat bounce, or drunk on Irish whiskey?

The last few days may not be an early Santa Rally in any case, since it came with a drop in the Dollar and a rise in the Euro, after it had been beaten down from $1.42 to $1.30 to the Dollar. The Dollar’s strong run in November coincided with a flat market, and its sharp fall the last few days corresponded to the sharp rally in stocks.

Hence, as is typical with trying to predict markets from fundamentals and seasonal patterns, the noise overwhelms the signal.

Technical Analysis

Technical analysis, however, gives some interesting guidance. The leading pundits generally agree that we are in the final stages of the Hope Rally, in a wave C. The wave pattern within C is pretty clear and leads to two scenarios:

- we have finished a minor wave 4 correction and are in a several-week final wave 5 (Neely)

- we are still in a sideways wave 4 and the wave 5 rally is ahead, but close (STU)

In both cases, the wave 5 should send the market to a new recovery high, albeit not necessarily much above Sp1227. Also in both cases, the expected reversal should come in January. Where they differ is whether the wave 5 rally has started already, or is it a few weeks out? This is the same question as whether we have begun the Santa Rally, or will it start a week or so farther out.

Today the monthly EWFF explored the market in detail. They note that it is possible that we have begun the final wave 5, although if so the two corrections within it (waves 2 and 4) would both have been sharp corrections, violating the Rule of Alternation. Well, as we found in Pirates of the Caribbean, sometimes rules are just guidelines. As I have pointed out several times, the Hope Rally from March 2009 to April 2010 also violated the Rule of Alternation, which calls into question how it is interpreted.

The coming week could give a tell, but more likely will continue the conundrum. Within the sideways wave 4 scenario, this current thrust up could go to a new recovery high without being the final wave 5; this is a characteristic of an expanded flat or running triangle.

My suggestion is to watch the Dollar for guidance as to stocks.

Leave a Reply