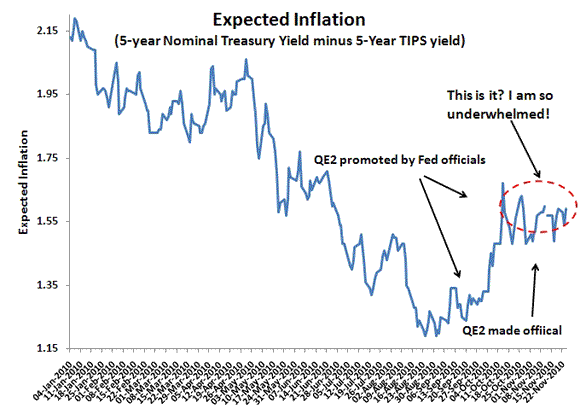

Many years ago a good friend invoked a boxing analogy in advising me on one of my many futile romantic pursuits. He told me that if in my pursuit of a certain woman I go down, I should go down swinging. Never look back with regret. I couldn’t help but think of his advice when considering your pursuit of a more robust economic recovery via QE2. There is no romance in this case, but you do claim to be passionate about stimulating more economic activity via a monetary-induced surge in nominal spending. As you know, a key part to fulfilling this passionate pursuit of yours is to meaningfully raise inflation expectations (and by implication expected nominal spending). So are you giving it your all? Are you willing to go down swinging? The bond market says you ain’t really trying:

This figure shows average annual expected inflation over the next five years has been flatlining around 1.55% over most of November. For all the hopes and fears of QE2, this response is underwhelming. There is no passion in this figure! Time to change that. Come out swinging with an explicit nominal level target–preferably a nominal GDP level target–and a commitment to maintain it no matter the cost. Stand tall when blows from the political left and right try to undermine your efforts. Make the markets believe you are serious about shoring up nominal spending. Make them believe you will go down swinging if needed. Show them you are the man!

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply