Shares of Yahoo Inc. (YHOO) rose as mush as 7.1 percent in Nasdaq trading, the highest intraday price since April 26, on a report that PE giant KKR & Co. (KKR), a global asset manager with more than $54 billion in assets under management, joined the list of leveraged-buyout firms interested in a potential move to take Yahoo private, the New York Post reports, citing unidentified sources.

The Post story says that KKR co-founder George Roberts “is friendly” with Yahoo co-founder and former CEO Jerry Yang, who rejected a takeover offer from Microsoft (MSFT) in 2008.

The Post story also notes that KKR’s interest is separate from that of other PE firms that have held preliminary talks with AOL Inc. (AOL) about a possible tie-up with the owner of the largest U.S. Web portal. Among the participants in those talks are private-equity funds Silver Lake and The Blackstone Group (BX), the piece says.

Yahoo hired Goldman Sachs (GS) in mid-October to handle takeover approaches. Whether talks will lead to a deal remains to be seen, but according to one Silicon Valley insider, it is only a matter of time before Yahoo is forced to make a move.

“The Valley is convinced Yahoo! will be sold. The blood is in the water,” the insider told the Post. “Yahoo! is in play.”

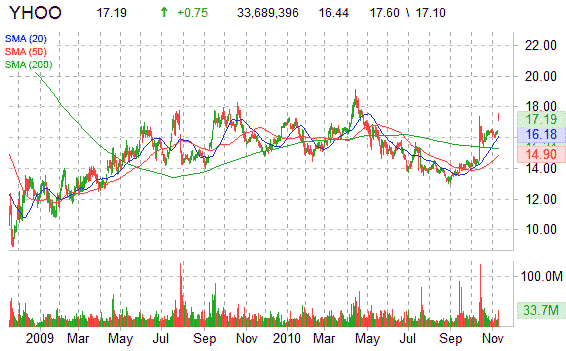

At last check, YHOO shares were up $0.75 to $17.19, a gain of 4.6%.

Today’s volume is huge: nearly 34 million shares by 1:28 p.m. ET. Ticker’s average volume over the last 13 weeks is 22.8 million shares.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply