JinkoSolar Holding Co. Ltd. (JKS) is off to a hot start as a publicly traded company, with its share price up more than 200% since its May IPO. With a 41% Q2 earnings surprise driving shares, this Zacks #1 rank stock has plenty of upward momentum.

Company Description

JinkoSolar Co. Ltd. operates as a solar energy company that specializes in manufacturing mono-crystaline and multi-crystalline silicon wafers. The company was founded in 2006, is based out of China and has a market cap of $548 million.

With global economies on the mend and crude prices remaining in elevated territory, solar companies are once again on the upswing. That dynamic lifted JKS to better than expected Q2 results from early August that included a 41% earnings surprise.

Second-Quarter Results

Revenue for the period was up 64% from last year to $133 million. Earnings also came in strong at 76 cents per share, 41% ahead of the Zacks Consensus Estimate.

The company’s strong results were driven by growing demand and higher production capacities, where total solar product shipments increase to a record 99.9 megawatts from 83 last year.

JinkoSolar was able to compliment its solid top-line growth with effective cost controls, with gross margin expanding to 27% from 23.7% last year.

Balance Sheet

The company leveraged the good quarter and recent IPO to strengthen its balance sheet, where its cash position more than doubled from last year to $81 million against a total long-term borrowings of $51.5 million.

Estimates

Estimates took a nice jump forward on the good quarter, with the current year adding $1.35 to $3.58, The next-year estimate is up $1 in the same time to $3.66, a modest 2.5% growth projection.

Valuation

Not only does JKS have some really nice upward momentum right now, it also has value, trading with a forward P/E multiple of 7X compared to its peer average of 11.5X.

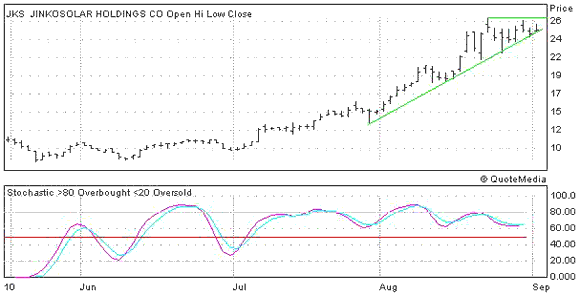

6-Month Chart

JKS has more than tripled in price since its IPO in Mat, recently hitting a new nigh above $25. A short-term trend line has been supporting prices since early August, take a look below.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply