Covenant Transportation Group, Inc. (CVTI) has made a big turn around and is not trading at multi-year highs. Analysts are making drastic estimate revisions on the heels of the most recent earnings report.

Company Description

Covenant Transportation offers premium transport services and brokerage, mainly in the continental US.

Revenues Up 17%

The company released earnings results on Jul 21 that included a 17% revenue increase, to $169 million. Net income came in at $2.9 million, or 20 cents per share.

Analysts were looking for just 16 cents, giving Covenant back to back earnings surprises. Additionally, management had several good comments, calling this the best quarter in years.

Moving forward they expect the freight market to continue improving. Rates are also climbing which leaves them “encouraged and optimistic about the future.”

Analysts React

In the past month the Zacks Consensus Estimate for this year is up to 28 cents, from a 1 cent loss. Last year Covenant posted a 96 cent loss, making this quite a turnaround story.

Next year’s estimates are averaging 61 cents, up 30 cents in the last months.

Valuations

Shares of CVTI are trading with solid valuations. At $9.50 you are paying less than 16 times next year’s estimates. But, given the turn around the price to sales of 0.2 is much more telling of the value. The price to book of 1.3 is well ahead of its peers, which average 2.0.

Hot Industry

Transportation companies have been posting very solid results, with UPS and FedEx being the great examples. Currently, trucking is 17th ranked industry out of 264 on Zacks.com.

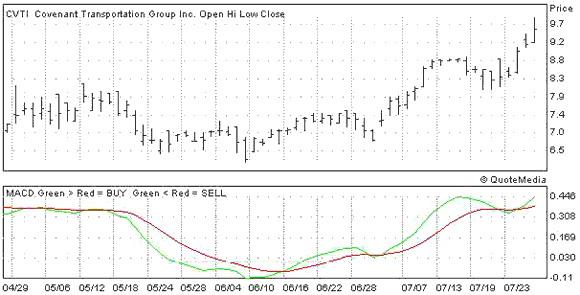

The Chart

Covenant’s stock spiked on the quarterly news and has made its way to a new multi-year high.

COVENANT TRANS (CVTI): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply